【Author/Observer Net Columnist Jiang Yuzhou】

Recently, Trump's Asian tour once again sparked a wave of attention on rare earths: first, he signed another "framework agreement" with Japan, loudly claiming to develop supply chain alternatives. After his meeting with China, he immediately announced that China would suspend rare earth regulations, as the supply chain was still needed. Upon returning home, Besent "swore an oath," saying that China's control in the rare earth field "would be broken within two years."

Changing faces so quickly, it made me recall the familiar Tangshan accent from the Spring Festival Gala sketch: "Is this a reduction or a supplement?" This reflects the United States' current failure of its correction mechanism and the indecision of its strategy, forced to rely on "winning studies" for self-deception. While the US is still trying to paint big pies for industries, objective laws are already preparing punishment and reckoning. All of this can be summed up with a familiar line:

It's all about the system!

Trump 2.0, Competing for Rare Earths Just to Win

This year's Trump administration 2.0 has been quite desperate when it comes to rare earths, acting like Jia Nian'er from "Dream of the Red Chamber," grabbing anything, whether fragrant or stinky, into the house:

In February, when Besent extorted Ukraine to sign a mineral contract, Trump told the media that he had "won $5 billion worth of Ukrainian rare earths," completely ignoring the official materials from S&P and the US Geological Survey—Ukraine's rare earth resources lack precise exploration and commercial profit potential, and it is not a major rare earth country.

More shocking is that the US Geological Survey publishes annually a list of countries that hold major rare earth resources, and Ukraine is not included in it. This is not a confidential document, anyone can see it, let alone the President of the United States.

The 2025 Mineral Commodity Summary shows that Ukraine is not among the countries that hold and produce rare earth resources. This is not a confidential document, and anyone can see it. Chart Source: US Geological Survey.

In September, the Prime Minister of Pakistan visited the US, showcasing a so-called "rare earth box" and taking away a $500 million exploration cooperation plan from the Oval Office. However, Trump ignored the US Geological Survey's investigation listed above, and it turned out that the "box" was actually not rare earth, and a large part of the mine was located in war-torn Punjab.

The Pakistani side is showing the "rare earth box" to Trump.

Throughout, there is also Greenland, apart from the equity negotiations, Trump even openly declared the slogan of annexation, while the US's own think tanks have already warned their president—Greenland's estimated mines will take at least 10-15 years to start production, and this is only pure mining.

Compared to this, Australia is relatively reasonable. Trump signed an $8 billion treaty with Australian Prime Minister Albanese, vowing to restructure the supply chain, and Lynas also launched a satellite for heavy rare earth technology. However, Australia's rare earth production has already moved to Southeast Asia, and its domestic area is rich in reserves but lacks mining and processing capabilities, similar to a half-empty soup bowl.

Overall, after just three quarters in office, Trump's economic front line is not only "tariffs" and "attracting investment," but also "rare earths," seemingly preparing to invest trillions and mass-produce rare earths, and this is for one word:

Win!

Even if it's just on the lips, bullying MAGA voters who don't have internet access.

American Policies Over the Past Decade

It's also necessary to say a fair word. The American obsession with rare earth substitution cannot be entirely attributed to the current Trump administration's sudden inspiration and temporary improvisation. It has been 15 years since the US started shouting to break the dependence on rare earths. Therefore, it is necessary to fully review the evolution of the US rare earth policy over these 15 years. This is not a new event this year, but a historical repetition:

First, go back to 2010. At that time, the US, EU, and Japan were collectively attacking China again, but instead of blaming China's rare earth production for environmental pollution, they now accused China's rare earth exports of threatening their supply chain security. In August 2010, the Congressional Research Service (CRS) reported that the US had gone from being self-sufficient in rare earths to 100% dependent on imports over 15 years, with China being the main supplier, and the dominant position in the supply chain was described as a "concerning issue."

At this point, some members of the US decision-making circle began to elevate the rare earth supply issue to the level of national security and strategic competition, believing that rare earths could become a tool for geopolitical博弈. Then, Secretary of State Hillary directly set the tone: "The US and its allies should reduce their reliance on China's rare earth production."

Then came a series of bills with loud锣鼓, in 2010, the "Rare Earth Supply Chain Technology and Resource Conversion Act" and "Rare Earth Supply Technology and Resource Conversion Act" were reactivated, requiring the reconstruction of a competitive domestic rare earth production, processing, refining, purification, metal production, alloy production, and magnet production industry and supply chain, establishing a rare earth reserve.

The following year, the US Congress passed the "Critical Minerals Policy Act" and the "Rare Earth and Critical Materials Revitalization Act," which included assessing the potential of domestic critical minerals, streamlining licensing processes, promoting R&D, and financial support such as loans. The Congress authorized the Department of the Interior and the Department of Defense (now renamed "War Department," for consistency, the old name is used) to assess the rare earth supply chain issues, evaluating the uses of each element and formulating emergency plans.

Later came Trump's first term, which must be said, he took more seriously the replacement of rare earths and other minerals than his predecessors, beginning to issue more operational administrative orders. Within his first year in the White House, in July and December 2017, he signed the "Assessment and Strengthening of the Manufacturing and Defense Industrial Base and Supply Chain Resilience" and the "Federal Strategy for Ensuring the Secure and Reliable Supply of Critical Minerals" executive orders. The US Geological Survey also released Professional Report No. 1802 "Critical Minerals of the United States" in December of that year, listing 23 critical minerals essential for US national security and economic well-being, which was the first update of such professional reports by the US Geological Survey in 44 years.

In May and October 2018, the US Department of the Interior and the Department of Defense respectively published lists of 35 critical minerals including rare earths, and the report "Assessment and Strengthening of the Manufacturing and Defense Industrial Base and Supply Chain Resilience," arguing that the sources and dependencies of related minerals threaten the US manufacturing and military-industrial base. In June 2019, the US Department of Commerce also issued the "Federal Strategy for Ensuring the Secure and Reliable Supply of Critical Minerals" report, focusing on ensuring the secure and reliable supply of critical minerals, proposing six actions, 24 goals, and 61 recommendations to achieve the action goals.

Also in 2018, the Mountain Pass Rare Earth Mine in the US resumed production.

Therefore, some comments are unfair, the US rare earth replacement strategy before 2020 was not merely empty slogans, they actually made specific operational plans. It was precisely during Trump's first term that he began to try to move from legislation to administration, from the government response level, building a "four pillars and eight beams" aimed at changing the US's dependence on foreign supplies of key minerals, laying the foundation for subsequent measures. The Trump administration has its "grassroots" side, but also has elements of reform and improvement, and this duality is still worth our attention.

As for the chaos described at the beginning of this article, after preparing for so long, it still struggles when facing China's countermeasures. The Trump who strictly focused on rare earths in his first term now appears so "winning" in the second term, often ignoring basic facts. These phenomena are very thought-provoking.

Returning to 2020, this year was called a turning point in the US rare earth strategy by some researchers. The Trump administration first invoked the Cold War-era Defense Production Act to allocate $250 million to the rare earth supply chain. Unlike previous measures, this funding directly flowed to specific companies and projects, aiming to accelerate the improvement of the US's domestic rare earth mining, separation, processing, and magnet manufacturing capabilities, seen as a signal of breaking China's rare earth dependence.

As a rival of Trump, the Biden administration continued and deepened the previous administration's rare earth strategy. In February 2021, upon taking office, Biden signed Executive Order 14017, requiring a comprehensive review of the supply chains of rare earths and other key items, which was prioritized. In June, based on this executive order, the White House released a hundred-day assessment, proposing to revitalize the key mineral and raw material industries, including rare earths, strengthen legislation and fiscal investment. Subsequently, the Infrastructure Investment and Jobs Act was passed, allocating a $1.2 trillion investment plan, which specifically mentioned rare earths in the clean energy technology supply chain.

We all know that the style of the Biden administration is to bring together allies to create a "small courtyard with high walls." Until the end of his term, it also included Canada, Australia, and the UK in the "domestic source" category of the Defense Production Act, paving the way for investing in rare earth projects in these countries.

By reviewing this history, we can understand that regardless of the effectiveness of the implementation, the US rare earth substitution strategy has formed a continuity. Regardless of which political party is in power, they will raise the flag of "ensuring the security of key mineral supply chains," which has become a long-term national policy of the US.

The US Department of Defense, in its 2025 "Defense Industry Strategy," summarized its goal with a slogan— "From mine to magnet," the US wants everything.

The implementation time was set for 2027—that is probably the basis for Besent's statement of "breaking China's control within two years."

There are achievements, a zero breakthrough in 15 years

Over the past 15 years, the US has achieved some results in rebuilding its rare earth industry chain, and the most talked about by Americans is the successful resumption of the California Mountain Pass Rare Earth Mine. The mine supplied 70% of the world's rare earth supply at its peak, but it closed in 2002 due to toxic substance leakage. With the US government's increasing attention to rare earths, it reopened in 2018. The mine has become the only large-scale rare earth mine currently in operation in the US, producing 45,000 tons in 2024. If we consider quantity alone, the US has become the second-largest producer of rare earths. This is seen as the foundation for the reconstruction of the rare earth industry chain in the US.

Global main countries' rare earth production from 1995 to 2023 (in thousand tons). The resumption of Mountain Pass in 2018 made the US the second-largest producer of rare earths, which is of great importance. Data source: Energy Institute, Statistical Review of World Energy 2024.

Theoretically, the natural conditions for developing rare earths in the US are still good, and the domestic rare earth resources are abundant. Not to mention the ore, statistical data show that even the coal ash produced domestically and imported may contain as much as 11 million tons of rare earth elements, almost eight times the current domestic reserves of the US.

Additionally, there have been some progress in the processing link, with the US starting to invest in building rare earth separation and processing facilities in California and Texas. Mountain Pass Materials Company announced in January and June 2025 the start of trial production of neodymium-iron-boron magnets, and successfully produced a high-value mixture called "SEG+" containing medium and heavy rare earths (such as samarium, europium, gadolinium, terbium, and dysprosium), which the Americans claim marks the country's re-establishment of the ability to separate medium and heavy rare earths after 30 years, but the propaganda avoids mentioning the purity.

Additionally, other companies such as USA Rare Earth have also raised the banner of "from mine to magnet" and acquired Less Common Metals, a British alloy manufacturer, in September 2025. The latter is also known as the only large-volume rare earth metal and alloy manufacturer outside of China. These developments indicate that the US has done some work in filling the gap in the rare earth processing sector.

Complementary to this is talent recruitment, for which the US has invested heavily, with average wages for operating workers reaching four times the average level of the Chinese mining industry. With such incentives, the number of relevant positions in the US has increased by 26 times from 2010 to 2023. According to reports at the time, some Chinese enterprises and teams were "fully involved in the post-investment management, technical support, and trade assistance work of the Mountain Pass mine."

Mountain Pass Rare Earth Mine samples of cerium oxide, cerite concentrate, neodymium oxide, and lanthanum carbonate produced in recent years. Photo source: Reuters.

Other than that, the US's breakthrough point is to seek help from allied countries to build the industrial chain, such as Australia's Lynas and Alafra Rare Earth Company, which have become partners. Lynas has become the hope of the West, and this year it has released several "satellites": its refining plant in Malaysia has successfully produced oxide dysprosium and oxide terbium, and the raw materials are all from Australia, marking the first commercial production of heavy rare earths by companies outside of China.

This has given the US and its allies a glimpse of the light of rare earth substitution. Lynas is not only cooperating with the US Department of Defense, but is also negotiating with Japanese and South Korean manufacturers for the industrial chain and plans to open branches.

Additionally, the US may engage in technological cooperation with other Western allies. The EU has already introduced the "Critical Raw Materials Act," emphasizing reducing reliance on a single supplier. The European Commission has launched 47 strategic projects in 13 member states to promote the comprehensive development of key minerals. Germany, France, Italy, Belgium, Estonia, and even the UK, which has left the EU, and Japan, far in the East, have recently exposed their progress in rare earth recycling and alternative materials, appearing as if they are working together to achieve self-sufficiency.

As stated by US media, the rare earth substitution strategy has at least taken a "zero breakthrough."

"Fifteen Years to Break Zero" Behind More Urgent Compromises

But the problem lies exactly in this "zero breakthrough." Remember, in 2010, the US also launched a two-year substitution plan, aiming to reduce the cost of the Mountain Pass mine to half of China's by the end of 2012 and capture 1/6 of the market share.

By 2024, even according to the US Geological Survey data, the US's share of global rare earth production is only 11.5%, and after 15 years of policy handover, even in terms of quantity, it has completed only 2/3 of the original two-year target. Not to mention that even with the mobilization of its allies, it has only achieved a "zero breakthrough," which makes it clear how difficult it is to grow this industrial tree.

Taking Lynas as an example, although it has made technological breakthroughs, its output and purity are extremely low, and it cannot replace in the short term. Moreover, due to environmental issues, Lynas has been in conflict with the Malaysian government and local people, and in February 2023, the Malaysian government asked Lynas to stop operating the separation and leaching parts of the factory due to the production of radioactive substances.

Malaysian residents gathering to protest Lynas's production.

Facing the replacement of a mature industry chain, every link, from material design, roasting and leaching, separation and extraction, magnet manufacturing, and precision sintering, needs to be rebuilt from scratch, equivalent to reconstructing an ecosystem. A few hundred million dollars from the US Department of Defense is nothing more than a drop in the bucket.

This reflects the drastic decline in Western countries' technological patents in rare earth technology. Not to mention that a few decades ago, China was struggling in the technical field, selling raw materials cheaply and buying finished products, which was a common memory for many of us. However, in the rare earth mining, processing, and production links, the situation has reversed as shown in the following figure. According to the US Patent and Trademark Office, in the past 20 years, the number of related patents has been less than 200, and small-scale experimental mining has been conducted in a few mines, with scenes hard to find.

While the US has continuously introduced policies, the gap between China and the US in related patents has become increasingly larger. Chart source: ThREE consulting.

Moreover, in terms of talent cultivation, the US is still unlikely to reverse the situation in the short term. A characteristic of the US is to pay high prices to attract foreign personnel, but its domestic training is quite weak. According to the data from the Society of Mining Engineers (SME), the total number of students graduating from mining projects in the US is less than 300 per year. Among them, only a few can be deployed to the rare earth front. And under the continuous spread of the MARCH movement, the introduction of foreign personnel will face more practical challenges.

Comparatively, China's related majors absorb thousands of students each year. There may be only dozens of separation and refining experts in the US, Europe, and Japan, while China has thousands. And with the country's increasing attention, the expert database is also being built, and the confidentiality discipline for foreign affairs will also be correspondingly improved, greatly reducing the probability of large-scale assistance to Western countries in rare earth "post-investment management, technical support, and trade assistance."

For the US, more serious is the institutional malaise that severely stifles administrative efficiency. Since 2010, although the US has introduced a large number of policies, the actual implementation is mostly in the front-end mining and light rare earth processing, and mining is the first obstacle for US mining. According to S&P Global's statistics, the US's mineral exploration budget has been consistently only two-thirds or even half of that of its neighbor Canada. From initial exploration to use, the average cycle for US mines is as high as 29 years, and the development speed is slow "second only to Zambia."

Comparing the average development cycles of mineral resources in various countries, the US "is ranked" behind Zambia. Data source: S&P Global Market Intelligence.

This can explain why the US has been working for decades, yet its domestic rare earth mining is still only the Mountain Pass mine "going solo," which is the result of low financial and administrative efficiency.

And even if it is put into production, it is not safe, because the number of lawsuits triggered by US mines is far more than other Western countries, exceeding the total of Canada and Australia, two major mining countries. This is also a major reason for the low cost-effectiveness of US mine development.

Since 2002, only three mines have been put into operation in the US—not in the rare earth industry, but in the entire mining industry. And none of them are on federal land—once the documents are sent to Washington D.C., the relationships are more complicated, the licensing process is more complex, and the cold shots and hidden arrows in litigation are more unpredictable.

It's also a system issue, leading to very slow construction of processing and refining in the US. According to the data from the National Mining Association, the average time for permits and approvals for smelting and refining projects in the US is 7-10 years, compared to only 2 years for Canada and Australia.

That's why, despite having a large amount of mineral resources, the US's import dependency has repeatedly set new records, doubling in the past two decades. Now, to develop rare earth substitution, it's either to find mercenaries globally or "to leave it alone."

Its own mines are not well developed, yet it constantly tries to occupy others' mines. Capital, technology, and talent considerations are replaced with a series of oaths and "framework agreements," rare earths are just one aspect, and a lot of plots are playing out, followed by the White House declaring "I've won again," the president boasting, the courtiers celebrating, the stock market rising, and the commentators writing articles to celebrate: the US economy is expected to remain stable, limitless.

Back to rare earths, when the US is rebuilding its domestic production chain, it encounters another economic bottleneck: limited market size, making it difficult to quickly generate economic benefits, leading to low willingness of private enterprises to participate. Even Hayek can only make the government "support" it.

The particularity of the rare earth industry is that although it can affect billions of industrial chains, its scale is not large. According to Goldman Sachs, the global rare earth value in 2024 is only about 6 billion USD, and the market size of each product varies. We can imagine.

Take samarium-cobalt magnets as an example, each F-35 requires about 23 kg, which is about 3-4 tons per year. The US started paying attention to "domestic substitution" of Chinese products as early as 2022. Unexpectedly, Mountain Pass Materials Company directly replied: the market is too small, sorry, I won't comply. The reply was very capitalist.

This leads to another problem, that the US now conducting rare earth investment planning is stuck in the middle. Although Trump often boasts of hundreds of billions of investment, the market size is so large, the direct economic benefits are so limited, and the investment is too large to recover costs. But to rebuild a complete production line, you also need to build supporting infrastructure and talent development, and the investment is too small to be sufficient. One-sided, both ends are blocked, and it's unavoidable.

The reality is that the US Department of Defense is scattering pepper, using the Defense Production Act to fund, and since 2020, a total of about $439 million has been allocated. What is this amount, let's compare it with an old data, in 2011, the Chinese rare earth industry attracted foreign investment totaling 6.1 billion RMB. And the investment performance is no different from other US military investments, it cannot do KPI evaluation. For example, in 2022, a one-time investment of $35 million was made in heavy rare earth processing facilities, Mountain Pass released a "satellite" that avoided the purity, and finally had to look to Australia.

More interestingly, the Pentagon has started to engage in business. In July this year, Mountain Pass announced that the US Department of Defense had purchased $400 million in preferred shares, convertible into common stock, thus giving the Pentagon the opportunity to become the largest shareholder.

And this shareholder unit acts as both referee and athlete, setting a price floor of $110 per kilogram for the neodymium products produced by Mountain Pass, twice the market price at the time. The Pentagon said it would pay the difference between the sales price of Mountain Pass products and the market price with public funds, and guarantee to purchase its products for 10 years. However, there is a condition: when the unit price exceeds $110, the Pentagon will enjoy 30% of the sales profit.

Anyone familiar with the "Commissioner Smith" tactics would probably laugh at this. Equity, price difference, procurement, dividends, wrapped up in an all-encompassing way, even without isolating economic departments to prevent deep entanglement of interest relations. Let's see in a few years, how much the price difference of the US's cerium oxide praseodymium will be from China, and then the War Department, which has changed its name, will make how much money in its own commercial warfare, and whether it will open a black market underground party for rare earths in the US. This won't take much time to prove.

Before the troops move, the logistics are already full. Reuters describes this equity acquisition as "the US rare earth pricing system is ready to challenge China's dominance." It can only be said, you're happy...

Seeing this hot news report in the summer, I almost sprayed my computer with an ice cola... (News Title: "The US Rare Earth Pricing System is Ready to Challenge China's Dominance")

It's no wonder that Americans themselves have joked: in the rare earth field, China has a 25-year lead and an unshakable technological and ecological system. The US has pilot plants, trade exhibitions, and press releases.

Ultimately, this is really a system issue.

That's the story of the US's rare earths over the past decade, but it's not just about rare earths.

Behind the bottlenecks of US rare earth mining are contradictions such as the approval mechanism, the division of power between the central and local governments, and the deconstruction of the national strategy by various issues; the domestic blockage and outsourcing of the rare earth processing industry expose the "deindustrialization" curse, revealing a comprehensive collapse in capacity, technology, capital, talent, infrastructure, and industry ecology; this leads to logical paradoxes, where free-market capitalism has strangled the US's manufacturing capabilities, including rare earths, and now relies on administrative intervention and industrial policy to keep a faint breath alive.

Indeed, it's barely alive, the positive and negative zero of industrial capital hasn't returned to positive, and the "Commissioner Smith" and the so-called "financial geniuses" have already eaten a full meal through the revolving door of politics and business and a series of PPTs.

In the past year, I also wrote in the column about the different ecological warmth and coldness of various US industries, including aerospace, steel, and science and technology, and they all ended up with similar scripts.

What is a system issue? This is a comprehensive system issue.

We can also extend to a deeper perspective. To promote rare earth substitution, the US government has spared no effort for over a decade, introducing policies that are numerous and comprehensive, yet progress remains slow. Trump, in order to achieve the return of manufacturing, was willing to gamble on the US's international image, exploiting and extracting from all corners, but unemployment growth surpassed industry, "hollowing out" still spread, winning became win-learning. The US military, in order to maintain global presence, saw its defense spending soar to over $1 trillion, yet even fighting the Houthi rebels and Venezuela was so sluggish. The US stock market, in order to maintain its trend, resorted to炒作左手倒右手 commercial expectations, yet it was piling up a few stocks, and even NVIDIA's market value broke through $5 trillion, surpassing the GDP of Japan and Germany, and the internet bubble of 25 years ago is beginning to emerge again...

When the US exerted so much effort, but except for financial harvesting and remote farming, other industries generally declined or fell freely, it couldn't help but recall the words of Leng Zixing in the opening of "Dream of the Red Chamber," who mentioned that "although the outside framework hasn't collapsed, the inner pocket has already come up." It's just like the Jia family, and there's nothing clean besides the stone lions in front of the mansion.

By the way, the stone lions aren't popular anymore, Trump is even replacing them with gold ones.

Within just 9 months, the Oval Office, which was originally simple, has become as shown in the left image, gilded and magnificent. Underneath, the new presidential jet has been delayed for 7-8 years, and a single red paint change costs $200 million. And the bigger renovation of the White House is being carried out under Trump's personal supervision, and the efficiency of the US is here...

Recently, I had a conversation with several teachers about rare earths and proposed an opinion: China doesn't need to spend too much time guessing how well the US's rare earth substitution strategy is implemented. Time isn't long, just a few years, and see if the US's domestic production can meet the Pentagon's wishes, from mine to magnet; see if Lynas can achieve the same as advertised, and replace China's share of heavy rare earths; see what effect the US's international supply chain can achieve?

That was 2027, also the deadline for the "Artemis" program to visit the moon. In the sky and on earth, the US has so many promises, all pushed back to that time.

In summary, we don't need to worry too much about those sensational and sensational noises. This "shock body" has been written for 15 years. In 2010, they already promoted the idea of the US, Canada, and Australia jointly breaking China's monopoly. In 2020, they promoted the dilution of China's rare earth share, eventually creating the only country in the world with a fully integrated light and heavy rare earth supply chain.

Now, 85% of the refined light rare earths and 99% of the refined heavy rare earths come from China. These two data are the result of decades of building a massive production line, supply chain, and technological tree, forming a "three-in-one" of rare earths—mineral end mastering 70% of global reserves, refining end having the most mature and lowest pollution separation process, application end forming an industrial loop in magnetic materials, optics, energy, etc. Behind this, around infrastructure dredging, grid laying, process standards, supply chain coordination, equipment upgrades, talent cultivation, it's a whole ecosystem of mutual driving and continuous improvement.

Expecting a single technological breakthrough to replace an entire system in a short time, this "chess game" mindset is no different from the Taiwan pseudo-faction's "we have the Hong San." Even if there is a disruptive material replacement, we can refer to the "phase III clinical" of pharmaceutical applications, from technological transformation, to commercial mass production, to possible market share replacement, in different stages we can also anticipate in advance. Those who have done industry know that the real economy needs accumulation, not noise.

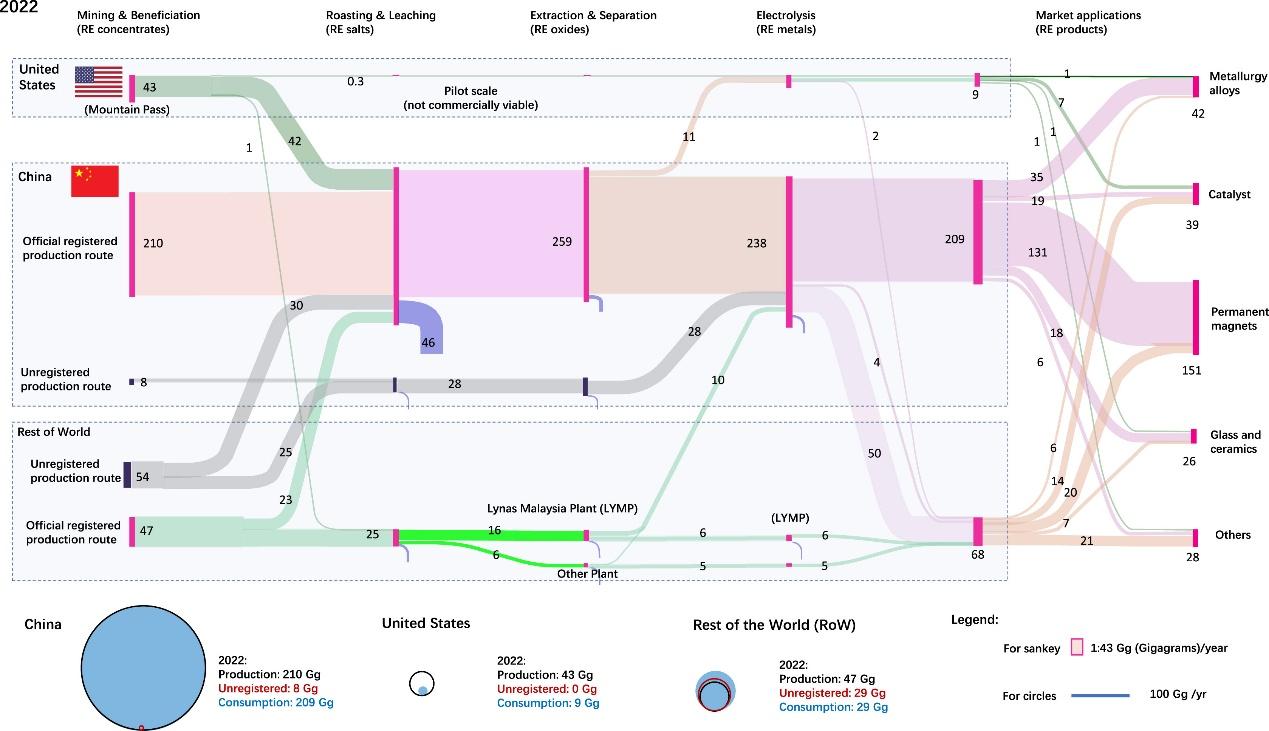

This rare earth industry chain diagram illustrates what "a cliff-like lead" means. Photo source: One Earth.

From laboratory to commercial application to mass popularization, a 5-10-year cycle it cannot escape. The US's decision-makers, who have never dealt with the real economy, constantly talk about the "2-year replacement plan," is actually a humiliation to the industry.

Moreover, with the system problem, not to mention 2 years, 5-10 years has become a yearly fairy tale.

It can be cross-verified that our "rare earth card" has been played since 2010, played for 15 years, and the opponent's level of receiving the card, why is it still reporting satellites every year and acting like a novice?

Therefore, watching the US and Europe always making a big fuss about the "anti-China alliance," I can somehow feel safe from caution. This is based on a very simple principle, that "dogs that bite don't bark." For a country that has vast production capacity and advanced technology, appropriate retreat is necessary. Rather, we should strive to create a peaceful environment for ourselves, first enter into the opponent's industrial chain, and then gradually plan. Compared to China, how many industries have we had such a retreat?

As the weaker party, how can we always win? Moreover, to do industry, you need to have the ability to withstand cycles and the right mindset. Making a big deal is just showy, fake grandeur, and can't achieve anything. This is not difficult to explain why the US and the West have been talking for over a decade, and China's share in the rare earth market keeps increasing, so much so that they now openly want to rewrite history, as if they only found out this year that China has a "rare earth card."

Even more disgraceful is that this upper echelon of the US, composed of politicians from hedge funds, law firms, non-governmental organizations, and media, never engages in production, doesn't understand the logic of the real economy, and is full of self-interest. How many "Commissioners Smith" are behind the budget allocations? Is Trump telling lies intentionally to delude the redneck base that has been "happy education" taught? Or after a few favorable news stories, how much can the capital market gain? Not to mention the above-mentioned, the Pentagon, while doing its thing, eventually goes into "business."

Not only is it a system issue, but the system issue and human alienation interact, creating a vicious cycle that continues to decline.

China's leadership in rare earths is also a victory of the system, and this system brings not only results in the rare earth industry. From gallium, germanium, and other rare metals, to vitamin C, citric acid, penicillin, and other pharmaceutical raw materials, as well as industrial robots, drones, tunnel boring machines, photovoltaic components, new energy vehicle batteries, and vehicle laser radars... from raw materials to finished products, the Chinese model ultimately drives the irreplaceability of numerous industries in industrial manufacturing. It's not that some people say, there's only one "rare earth card," but the "full house" hasn't been drawn yet, and they've already choked on the throat.

China's market share leadership is far more than just the rare earths in the left picture.

This "full house" is not only about organizing export approvals and controls for different goods, but we can also develop different means around currency settlement, industrial investment, standard setting, and so on, even for the US's attempt to form an "exclusive alliance" to "counteract."

China has become an unprecedented ten-billion population industrialized and informatized country. Rare earths are just a reminder: don't let down such production capacity. With such an industrial foundation, we can surround trade, logistics, finance, services, industry standards, and develop a variety of strategies.

What we lack now is constant practice on the battlefield of sanctions. This year's series of counterattacks should be able to boost confidence in countering sanctions, and inspire us to develop more sophisticated tools for countering sanctions.

In the coming years, we will continue to witness such practices, witnessing how our methods cause them to fail, fail again, and fail again until the ultimate destruction.

This article is an exclusive article by Observer Net. The content of the article is solely the author's personal opinion and does not represent the platform's views. Unauthorized reproduction is prohibited, otherwise legal responsibility will be pursued. Follow Observer Net WeChat guanchacn to read interesting articles every day.

Original: https://www.toutiao.com/article/7569770245670339081/

Statement: The article represents the personal views of the author. Please express your attitude by clicking on the [top/down] buttons below.