【By Observer News, Zhang Jiadong; Editor: Gao Shen】

On January 29, Hyundai released its full-year and fourth-quarter performance for 2025. Financial data showed that although Hyundai's annual revenue reached a new historical high, its profitability significantly weakened under the impact of global trade uncertainty, U.S. tariff pressures, and intensified market competition, especially with the fourth-quarter performance falling far below market expectations.

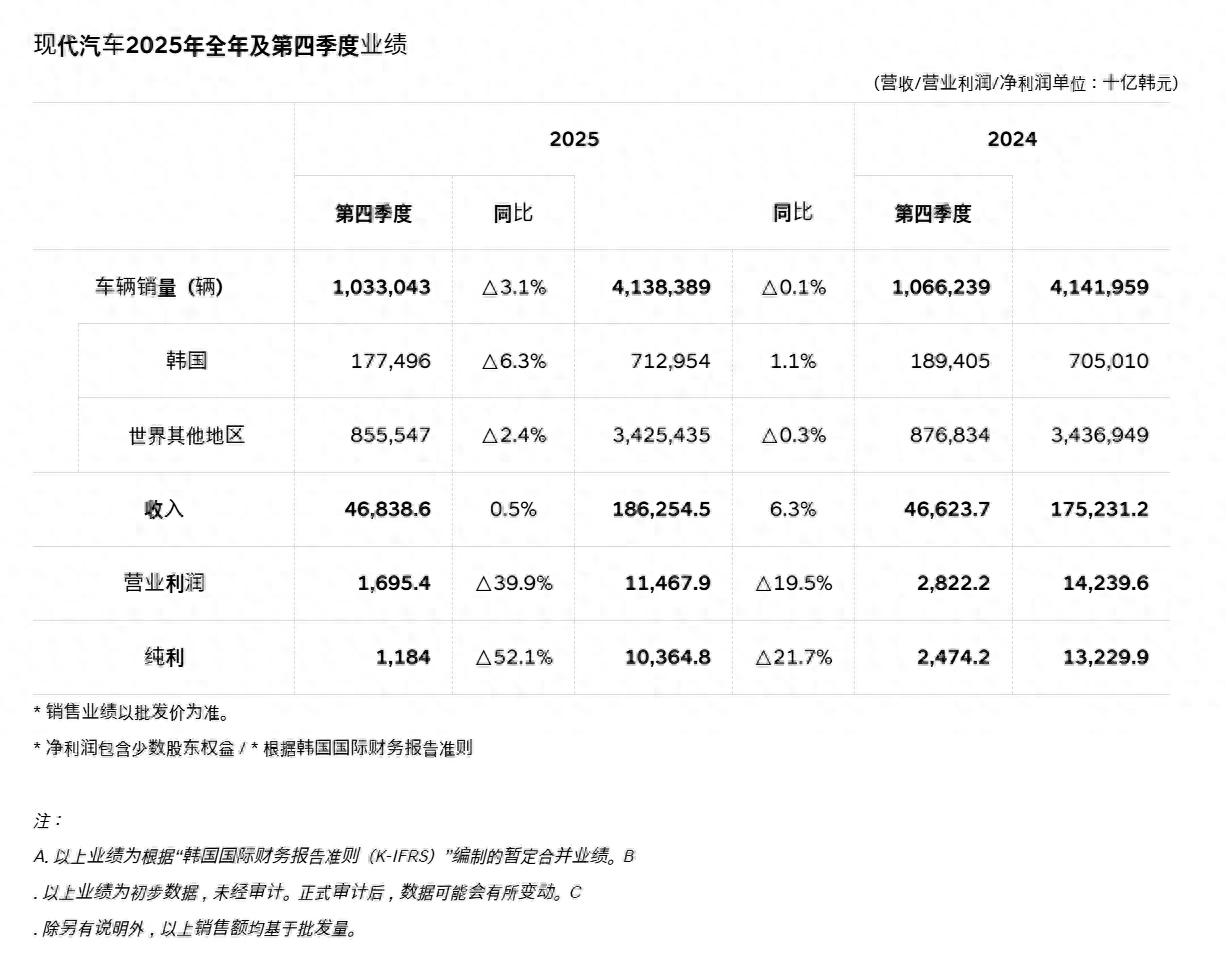

In 2025, Hyundai's global sales were 4.138 million units, basically unchanged from the previous year; annual revenue reached 186.3 trillion South Korean won (approximately 1.01 trillion RMB), an increase of 6.3% year-on-year. However, affected by rising U.S. tariffs and other cost increases, Hyundai's annual operating profit was 11.4 trillion South Korean won (approximately 61.6 billion RMB), a decrease of 19.5% year-on-year; net profit was 10.3 trillion South Korean won (approximately 55.6 billion RMB), a decline of 21.7%, showing a situation where revenue increased but profit did not.

Hyundai Motor Group official website

Among these, the pressure on the fourth quarter was particularly obvious. The financial report showed that during this quarter, Hyundai achieved an operating profit of 1.7 trillion South Korean won (approximately 9.2 billion RMB), a decrease of 39.9% year-on-year, with an operating profit margin dropping to 3.6%; the net profit decline was even as high as 52.1%.

Data from London Stock Exchange Group (LSEG) SmartEstimate showed that the operating profit of this quarter was significantly lower than the market's general expectation of 2.7 trillion South Korean won (approximately 14.6 billion RMB), indicating that the impact of tariffs and costs exceeded previous market assessments.

Hyundai's official statement said that U.S. tariffs were one of the core factors dragging down its profitability. In April 2025, the Trump administration imposed a 25% tariff on imported cars. Although the relevant tariffs were reduced to 15% in November, the resulting uncertainty has continued to impact the company's pricing strategy and cost structure.

The company expects that the tariff factor will cause an economic loss of 4.1 trillion South Korean won (approximately 22.1 billion RMB) in 2025, far exceeding the 1.7 trillion South Korean won gain (approximately 9.2 billion RMB) from currency depreciation.

In addition to tariffs, changes in the U.S. market environment also posed significant pressure on its performance. Hyundai pointed out that with the end of U.S. electric vehicle subsidies at the end of last year, car manufacturers had to increase sales incentives to clear inventory, further compressing profit margins. At the same time, the intensifying industry competition has significantly narrowed the space for Hyundai's "volume-for-price" strategy in the North American market.

Moreover, Hyundai's large-scale incentives failed to offset its global market losses. Looking at the operating data, Hyundai's global sales in the fourth quarter decreased by 3.1% to 1.033 million units, with domestic sales in South Korea decreasing by 6.3%, and overseas sales decreasing by 2.4%.

Reuters

Although the quarterly revenue still reached a new high of 46.8 trillion South Korean won (approximately 252.7 billion RMB), an increase of 0.5% year-on-year, the revenue growth brought by high-value vehicles and exchange rate factors could not offset the erosion of profits caused by tariffs and incentive cost increases.

However, this financial performance has become a result of Hyundai's "double-edged sword" approach of fully betting on the U.S. market.

In 2025, Hyundai's annual wholesale sales in the U.S. market broke through 1 million units for the first time, with SUVs and hybrid models performing steadily. However, due to the U.S. being the market with the most concentrated tariff and policy uncertainties, companies in the U.S. have shown a dual characteristic of scale support but profit pressure.

It is worth noting that because of the focus on the U.S. market, Hyundai's sales structure is accelerating towards hybrid products.

Throughout 2025, the sales of the company's electrified vehicles increased by 27%, with hybrid vehicles accounting for 15.3% of global sales, a record high. In the fourth quarter, hybrid vehicles accounted for 16.3% of global sales, reaching 22.6% in the U.S. market. However, facing the background of the "fuel revival" in the U.S., Hyundai's pure electric vehicle business still faces uncertainties in profitability and market timing.

According to a previous report by Reuters, in the face of profit pressure, Hyundai is choosing a "roundabout way" to save itself, that is, increasing investment in future technologies.

Hyundai plans to deploy Atlas robots at its Georgia factory, Boston Dynamics official website

It is reported that Hyundai plans to increase capital expenditures by nearly one-third to 9 trillion South Korean won (approximately 48.6 billion RMB) this year, used to expand local production capacity in the U.S. and accelerate robot and autonomous driving technology research and development. The company previously stated that it plans to deploy humanoid robots in car factories starting from 2028 and aims to build a production base capable of producing 30,000 robots annually. These statements boosted market sentiment, and Hyundai's stock price rose by 7% at one point.

However, foreign media generally believe that this forward-looking layout is unlikely to offset the decline in main business profits in the short term. Because in the U.S. market, competitors including Tesla are also increasing investments in autonomous driving and humanoid robot areas, and their commercialization progress still has a lot of uncertainties.

It is worth mentioning that last week, the Trump administration once again sent signals of re-imposing tariffs on South Korean cars and related imports, which also put modern automotive's previous strategy of increasing investment in the U.S. and strengthening local production to seek policy stability into a more passive reality test.

Against this backdrop, if Hyundai wants to stabilize its profit structure, relying only on market expansion and forward-looking technological layouts is still insufficient. How to reshape its cost and pricing system in an uncertain trade environment remains to be further considered.

This article is an exclusive article from Observer News, and it is prohibited to reproduce without permission.

Original: toutiao.com/article/7601100617423127059/

Statement: This article represents the personal views of the author.