From the world's second-largest economy to being overtaken by India, the latest data has been released, and Japan's economy has "lost 30 years."

Recently, Japanese Prime Minister Takahashi Sanae, who stirred up Chinese anger over the Taiwan issue, is taking over a country that is actually in a "mess." Japan's current economy is as precarious as walking on thin ice, with the entire financial system facing great uncertainty.

(The economic problems in Japan under Takahashi Sanae's administration are very serious)

World opinion generally says that Japan's economy has "lost 30 years," and this has been supported by the latest forecast from the International Monetary Fund (IMF): In 2025, India's GDP will reach $4.187 trillion, slightly surpassing Japan's $4.186 trillion.

This means Japan will fall from its once unshakable position as the world's second-largest economy to fifth place, behind the US, China, Germany, and India.

Naturally, we must acknowledge that there is more "water" in India's GDP, but it is a fact that Japan's economy has not grown much in the past three decades.

(G7 per capita GDP data, the red thick line is Japan)

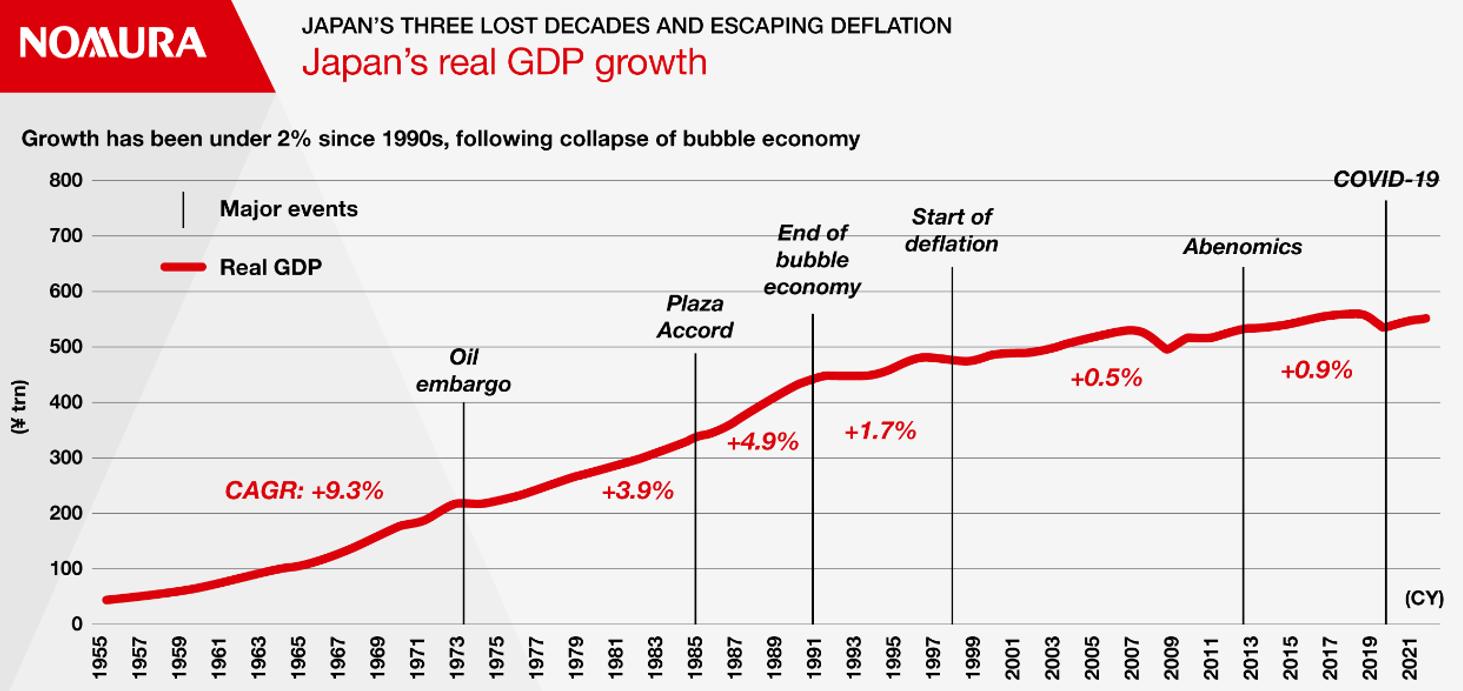

According to IMF data, Japan's per capita GDP in USD terms, except for 2011 and 2012 when it was briefly elevated due to "Abenomics" and an increase in the yen-to-dollar exchange rate, has been below $40,000 for most of the past three decades. Japan's per capita GDP in 2025 is even much lower than in 1995. The "lost 30 years" is an undeniable fact.

This is because Japan's GDP growth rate has been basically zero for most years during these three decades.

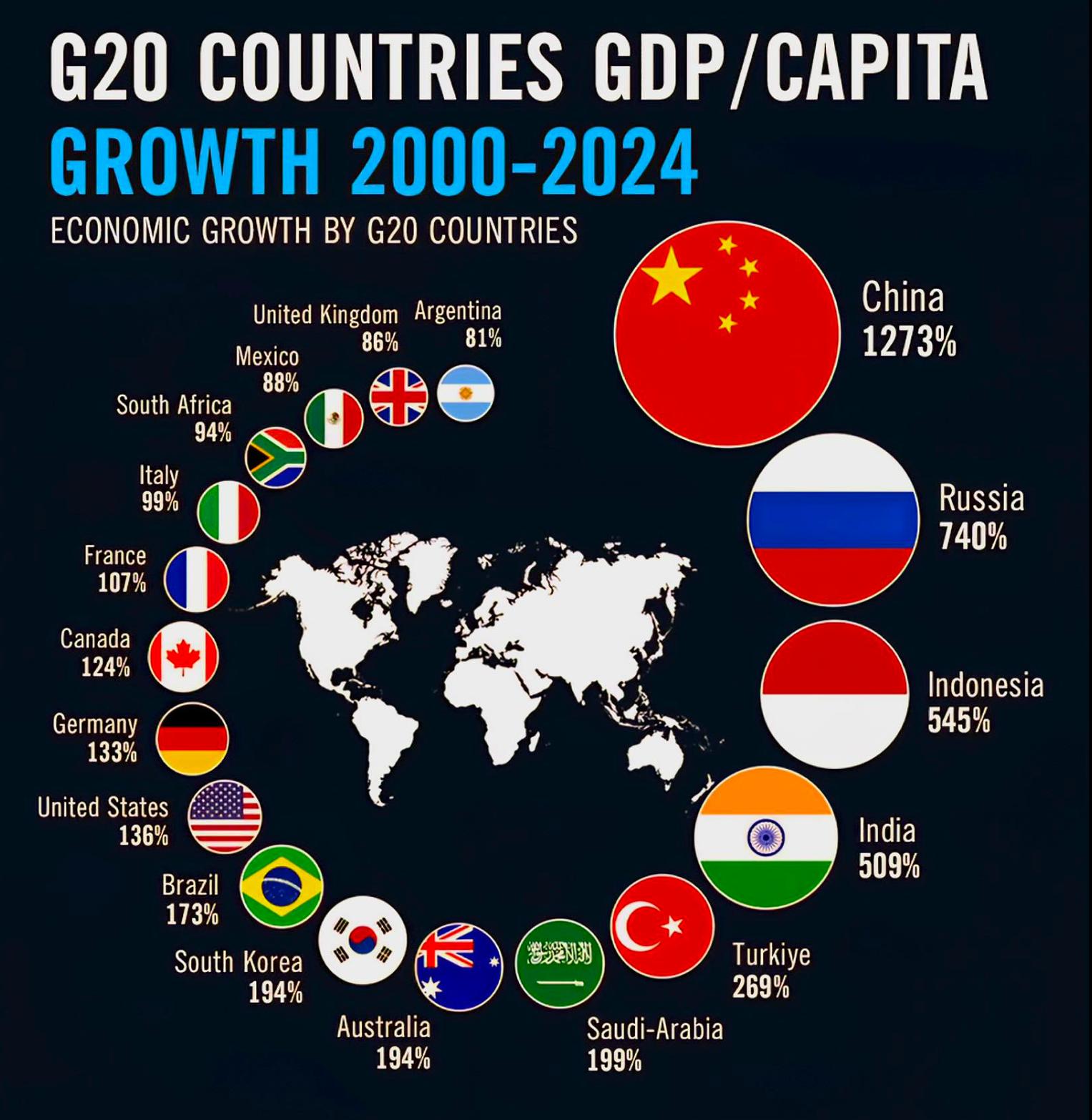

(G20 countries' economic growth rates over the last 24 years, excluding negative growth Japan)

According to World Bank data, G20 countries' economic growth rates from 2000 to 2024, even the slowest Argentina grew by 81%, while China achieved a staggering 1273% growth rate, leading the world. This chart does not include Japan because its GDP is in negative growth. The G20 also includes the EU as a whole, but this chart does not show it.

How did Japan get to this point? It is the result of multiple factors working together.

(Japan's GDP growth rate and major events over the past few decades)

First, this is the result of Japan's own erroneous economic and industrial policies.

Japan has experienced several major events in the past few decades. The Plaza Accord signed in 1985 with the United States can be considered the beginning of everything, but do not forget that Germany and France also signed the Plaza Accord. Why have Germany and France not experienced "the lost 30 years"?

The Plaza Accord caused a significant appreciation of the yen, but Japan did not take this opportunity to invest heavily in high-tech industries and the real economy. Instead, it fostered a bubble economy centered around real estate, stock, and other financial assets. By 1991, the bubble economy burst, and Japan's economic growth began to lose momentum.

Starting with the Asian Financial Crisis in 1998, Japan began to experience deflation. "Abenomics" temporarily solved the problem. Now many people blame the Plaza Accord for Japan's "lost 30 years," which is unreasonable. It was Japan's policy of moving away from the real economy and toward finance that led to this situation, even though Japan still has strengths in some industrial fields.

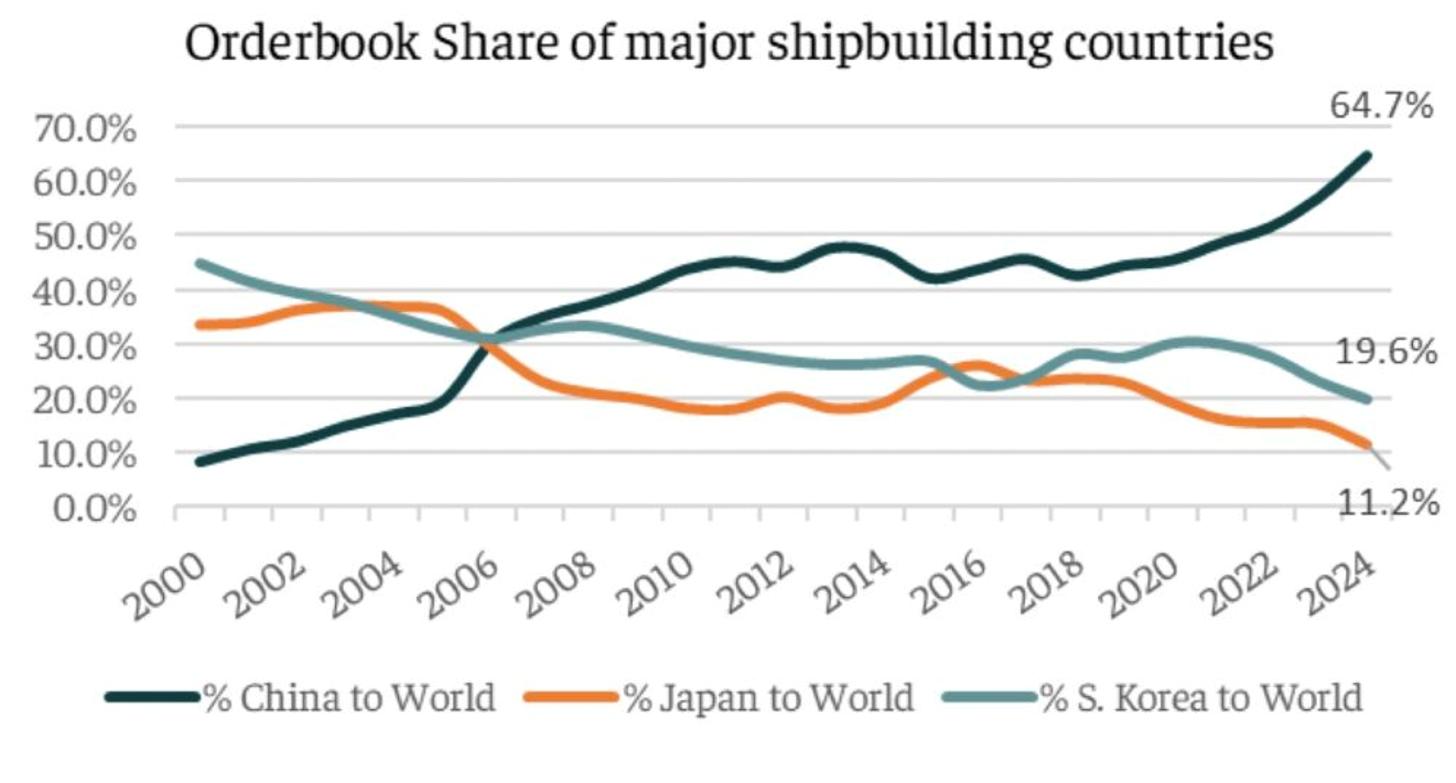

(Changes in the share of the global market for shipbuilding among China, Japan, and South Korea)

Secondly, Japan has been suppressed by American hegemony and made strategic miscalculations, causing it to miss the wave of the new economy.

Japan's semiconductor industry once occupied about half of the global output in the late 1980s. However, in September 1986, the Japanese Ministry of International Trade and Industry signed the first Semiconductor Agreement with the U.S. Department of Commerce. This measure restricted Japanese semiconductor exports to the U.S., while expanding the U.S. semiconductor market in Japan.

This ultimately led to Japan's global semiconductor market share dropping from 50.3% in 1988 to 20% in 1996, with DRAM markets replaced by Samsung of South Korea. By 2025, Japan's semiconductor industry's global share had fallen to only 6%, which is even less than China's.

Today, Japan's semiconductor industry is strong only in the upstream manufacturing equipment and materials sectors. The midstream semiconductor manufacturing has only a few categories remaining with competitiveness. The downstream semiconductor applications have significantly shrunk as Japan's home appliance industry was replaced by Chinese and South Korean companies.

In the new economy based on the Internet, Japan's conservative corporate culture caused it to miss the development wave, without producing any globally influential apps. In recent years, the AI wave, Japanese companies have basically gained nothing, and the global competition in large AI models has become a competition between China and the U.S.

Keep in mind that in 2025, the Japanese government is still using fax machines extensively, and even Takahashi Sanae uses this method to send documents. It is clear how outdated Japanese society is.

Thirdly, the rise of China and South Korea's industries directly hit Japan's previously dominant industries. Shipbuilding is one example: Japan's shipbuilding industry once shared most of the global market with South Korea, but with China's rise, in 2024, China's shipbuilding industry accounted for 64.7% of the global market, South Korea for 19.6%, and Japan for only 11.2%.

This situation also occurred in the home appliance sector. Today, Chinese home appliance brands already account for about half of the Japanese domestic market, and even their home has been lost. Chinese cars are entering Japan's traditional market, and the dark days for Japan's automobile industry are coming. Japan faces competition from China in almost all industrial fields and is retreating step by step.

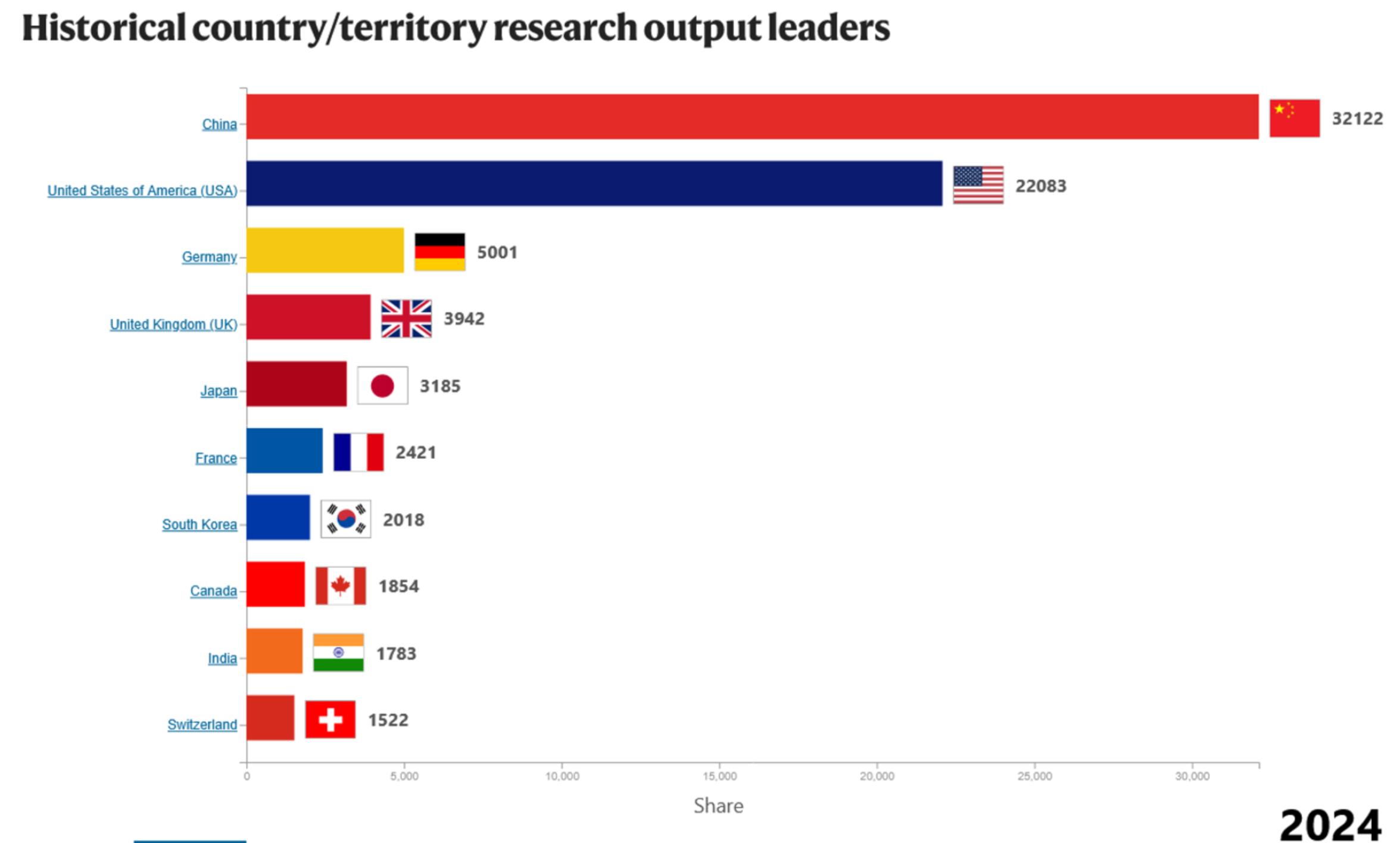

(Nature Index 2024 data, China is 10 times that of Japan)

Additionally, Japan's society has fallen into a low birth rate and aging trap, which is the biggest internal cause of Japan's economic shrinkage and lack of innovation.

Japan's investment in R&D cannot be called insufficient, but the input and output have been balanced for a long time. Under China's rapid growth and vast scale, it has been crushed. This can be seen from the Nature Index, which measures the number of high-level papers in basic scientific research:

In 2024, China not only surpassed the US but also reached ten times that of Japan. This is also the case in the number of international patents representing industrial innovation.

Also, Japan's wrong attitude towards its history of World War II has caused it to lose the golden opportunity for East Asian economic integration.

In 2012, the Northeast Asia Free Trade Area negotiations between China, Japan, and South Korea were already underway, but Japanese right-wing politicians suddenly provoked China's sovereignty on the Diaoyu Islands issue and provoked South Korea's nerves on the issue of comfort women and forced labor by Japanese troops during World War II, causing the Northeast Asia Free Trade Area negotiations to stagnate.

Now, with Takahashi Sanae as the representative of Japanese right-wingers, they are again touching the bottom line of China on the Taiwan issue. Japan will have no chance to maintain "cold politics and warm economy" with China anymore.

(Changes in Japan's 10-year Treasury interest rates, now at 1.83%)

Now, Takahashi Sanae wants to inherit the policies of her "spiritual mentor" Abe Shinzo, continuing the so-called "Abenomics," which is government stimulus through large-scale "water pouring and funding" to stimulate economic development.

Several days ago, the Takahashi administration just introduced a draft of a 21.3 trillion yen economic stimulus plan, but the problem is that Japan's economy is no longer in the state it was when Abe Shinzo was in power:

At that time, Japan was facing deflation, and the government bond interest rate was basically zero or even negative. Now, Japan's inflation rate has exceeded 3%, and the yield on 10-year government bonds has surpassed 1.8%. It is definitely not the time to "pour water and fund."

In 2024, the ratio of Japan's government debt to its GDP was 237%, far exceeding that of other major economies. For a long time, the Japanese government has relied on zero interest rates to maintain itself. If the government bond interest rate rises to a certain level, Japan may find it difficult to even repay the interest on its government bonds.

Where will the money for Takahashi Sanae's 21.3 trillion yen economic stimulus plan come from? It's still issuing more bonds, isn't it? Can Japan's government finances continue to sustain themselves?

Japan may continue to lose another 30 years, and this is not alarmist talk.

Original: toutiao.com/article/7579519691451580968/

Statement: This article represents the views of the author alone.