【By Chen Sijia, Observer's Net】In recent years, Chinese automakers such as BYD have dominated the electric vehicle market, rapidly capturing the European market with advanced technology and affordable prices. However, in the plug-in hybrid car sector, European traditional automobile manufacturers still hold a place, competing with Chinese companies by leveraging their advantages in conventional engines.

However, as Chinese companies continue to improve their technology, European companies are gradually losing competitiveness in the plug-in hybrid sector. On November 20, the Financial Times reported that Chinese manufacturers keep launching plug-in hybrid models with lower prices and longer range, which have won the favor of the European market. If the European market shifts to plug-in hybrid cars by 2035, the market will still be dominated by Chinese companies.

Plug-in hybrid cars are hybrid vehicles that can be charged via an external power source, equipped with both gasoline engines and large-capacity batteries, often seen as a "transition choice" during the shift toward electric vehicles. The main brands promoting plug-in hybrid cars in Europe are mainly concentrated in the premium market, such as Mercedes-Benz and BMW, because these types of vehicles are usually more expensive than other models.

After the EU increased tariffs on Chinese electric vehicles last year, many Chinese automakers also began promoting plug-in hybrid cars in Europe to avoid high tariffs. Compared to European brands, Chinese plug-in hybrid cars are cheaper and have stronger range, quickly winning the favor of European consumers.

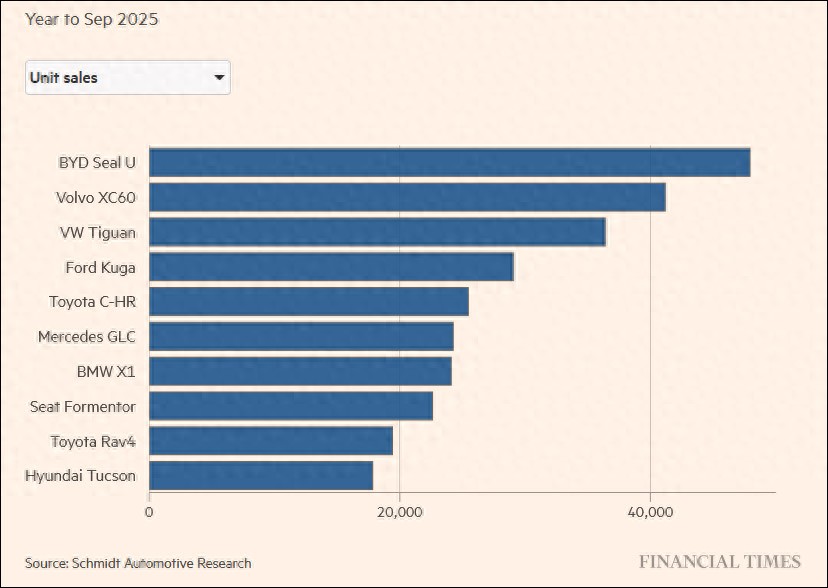

Data from Schmidt Automotive Research shows that the BYD Seal U has become the best-selling plug-in hybrid car in Europe, with a market share of about 5.5% in the first nine months of 2025. In the UK, the Chery Jaecoo 7 is the best-selling plug-in hybrid model in August.

European Plug-in Hybrid Car Sales in the First Nine Months of This Year, screenshot from the Financial Times report

The Financial Times pointed out that oil-electric hybrid models like Toyota Prius use traditional engines and small non-plug-in batteries, so the purchase and usage costs are often lower than those of plug-in hybrids. But as Chinese automakers expand production scale and master the battery supply chain, their plug-in hybrid cars have become more cost-effective.

For example, when the Chery Omoda 7 plug-in hybrid car is launched in the UK next year, the starting price will be 32,000 pounds, which is lower than the oil-electric hybrid cars sold by Toyota and Honda in the UK. The Omoda 7 offers up to 56 miles (90 kilometers) of pure electric range, while the second best-selling Volvo XC60 in Europe, which starts at 55,360 pounds, has a maximum electric range of 51 miles (82 kilometers).

Olivier Lowe, the UK product manager for Omoda and Jaecoo, said that Chery will continue to invest in improving the thermal efficiency of gasoline engines, "We expect the gap between us and previous plug-in hybrid car manufacturers will continue to widen."

Since the EU tightened carbon emission regulations in 2020, the sales of plug-in hybrid cars in Europe have continued to grow. According to data from the European Automobile Manufacturers Association (ACEA), the sales of new plug-in hybrid cars in Europe and the UK increased by 32% in the first nine months of this year, reaching nearly 920,000 units; electric vehicle sales grew by 25%, reaching 1.8 million units.

According to Schmidt Automotive Research, in the third quarter of this year, plug-in hybrid cars accounted for 10% of the new passenger car market in the region, with about one-seventh being new models from Chinese companies.

On September 27, the BYD Seal U DM-i was unveiled at the Turin Motor Show in Italy, IC photo

The Financial Times pointed out that in recent years, European traditional automobile manufacturers could still use their advantages in conventional engines to compete with Chinese companies in the plug-in hybrid car sector. However, as Chinese companies "open new battlefields," continuously launching plug-in hybrid cars with lower prices and stronger range, European automakers may lose to Chinese automakers at home.

Pedro Pacheco, an analyst at the technology consulting company Gartner, said: "Now, European automobile manufacturers cannot match Chinese automobile manufacturers in plug-in hybrid technology. If the European market shifts to plug-in hybrid cars by 2035, the market share will still be in the hands of Chinese automakers."

However, Germany, France, and other EU countries have recently canceled subsidies for purchasing plug-in hybrid cars, and the EU will further tighten emission restrictions, possibly leading to a decline in demand for plug-in hybrid cars in the EU. According to the report, the EU will also announce new automotive policies in December. Germany and the European automotive industry hope to continue selling plug-in hybrid cars after 2035, but France and Spain oppose it.

Plug-in hybrid cars still have significant demand in the international market. The International Council on Clean Transportation (ICCT) estimates that China's plug-in hybrid car sales have grown from about 240,000 units in 2020 to 4.9 million units last year, accounting for 19.5% of the new passenger car market. Last year, the average range of Chinese plug-in hybrid models was 116 kilometers, compared to 78 kilometers in Europe and 70 kilometers in the United States.

However, Jan Dornoff, head of research at ICCT, said that due to the decline in electric vehicle costs and the extension of battery range, demand for plug-in hybrid cars has slowed down. He believes that as battery costs decrease, electric vehicles will become even more affordable compared to the complex structure of plug-in hybrid cars.

This article is an exclusive contribution from Observer's Net, and unauthorized reproduction is prohibited.

Original: https://www.toutiao.com/article/7574800297059484201/

Statement: The article represents the views of its author. Please express your opinion by clicking on the 【top/beat】 buttons below.