【By Observer Net, Yuan Jiaqi】

On the 29th local time, "Nikkei Asia" reported, citing statements from local residents, that the Myanmar military has increased its deployment to provide security support for two mining sites operated by Chinese enterprises, ensuring their production operations, output capacity, and scale expansion.

Three sources told the Japanese media that a fleet of about 10 cargo ships recently carried out transportation tasks under the escort of a warship, an unmanned reconnaissance aircraft, and troops flying powered paragliders.

The report also mentioned that due to conflicts between the Myanmar military government forces and anti-government armed groups, the Laipeitang Copper Mine, a key demonstration project of the "Belt and Road Initiative" located in the Sagaing Region in northwest Myanmar, was forced to shut down for two years. Now, the military government is taking measures to ensure the mine resumes continuous operations.

In addition, the UK-based non-governmental organization (NGO) "Myanmar Witness" claimed that five buildings suspected to be military outposts have been built within the Laipeitang mine.

The Japanese media analysis said that on one hand, the Myanmar military's move is to maintain good relations with China, and on the other hand, it is to protect its few remaining high-profit foreign exchange sources. Affected by Western sanctions, the ability of the Myanmar military government to earn hard currency has been greatly weakened, and the mining industry has become one of its key revenue channels.

Data from the Myanmar Investment and Company Administration showed that since February 2021, China's investment in Myanmar has exceeded 530 million US dollars, making it the second-largest investor in Myanmar,仅次于 Singapore.

The Australian NGO organization "Publish What You Pay Australia" pointed out that during the fiscal year 2020-2021, the Myanmar military government earned approximately 725 million US dollars from three mines in Sagaing Region, of which about 57% of the revenue came from the Laipeitang Copper Mine.

The report pointed out that China has always been urging the Myanmar military government to ensure the safety of its investments in Myanmar.

On August 14, Wang Yi, a member of the Political Bureau of the Central Committee of the Communist Party of China and Minister of Foreign Affairs, met with Myanmar Foreign Minister Tin Aung Myint Oo and others who came to China to attend the 10th Foreign Ministers' Meeting of the Lancang-Mekong Cooperation in Anning, Yunnan. Wang Yi stated that China and Myanmar should deepen the construction of a community with a shared future for mankind, taking the 75th anniversary of diplomatic relations as an opportunity. The Chinese side supports the Myanmar government to walk a development path that suits its national conditions and is supported by the people, supports the Myanmar government to safeguard its sovereignty, independence, and national unity, and supports the Myanmar government to steadily advance domestic political agendas. The Chinese side hopes that the Myanmar government will effectively ensure the safety of Chinese personnel, institutions, and projects in Myanmar, further crack down on transnational crimes, and maintain peace and stability along the border between the two countries.

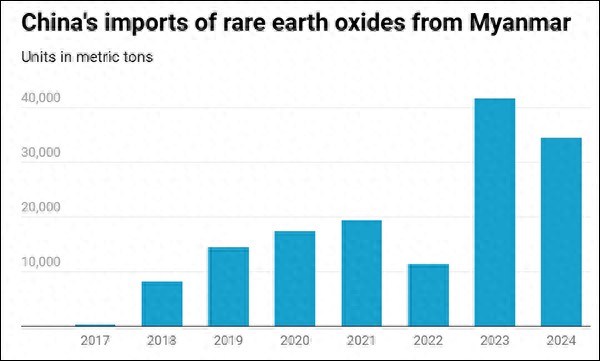

In recent years, China has increased its imports of rare earths from Myanmar.

Myanmar is the third largest producer of raw rare earths in the world and is an important source of rare earth raw materials for China. Over the past decade, Myanmar's rare earth production has surged from 200 tons in 2014 to 31,000 tons in 2020, ranking second only to China and the United States in terms of production scale.

Myanmar is also China's largest source of rare earth imports. According to a report from Guotai Junan, China's total import volume of rare earths in 2024 was approximately 77,300 tons, a decrease of 30% compared to the previous year; of which 44,000 tons were imported from Myanmar, accounting for 57%.

In particular, medium and heavy rare earths, which are relatively scarce and have broader application fields. In 2024, the amount of medium and heavy rare earth minerals imported from Myanmar reached 32,000 tons, which is 1.6 times the domestic quota for heavy rare earth minerals, making it especially important for the supply of domestic medium and heavy rare earth minerals.

However, the instability of the Burmese political situation and international trade frictions continue to amplify supply risks. After the outbreak of conflict in Kachin State in October 2024, the mining of rare earths in the area came to a complete halt, and the border was also closed, directly impacting the supply of medium and heavy rare earths in China. Although the border reopened in December of the same year, the increase in resource taxes by the local government caused a sharp rise in costs for miners, and the actual import volume did not reach expectations.

Guotai Junan previously analyzed that due to the closure caused by the civil war, the amount of rare earths imported from Myanmar into China dropped sharply to around 300 tons in December. Although the border reopened after December, the difficulty of negotiation between miners and the local government increased, and the import volume from Myanmar did not return to normal levels.

Regarding the stagnation of rare earth mining in Myanmar, a person related to the Chinese rare earth industry stated at the time that the company has its own mining resources and can ensure its production needs. Regarding whether this event affects rare earth prices, industry-related personnel did not directly answer, while a person from Northern Rare Earth believed that the reduction in supply may lead to a tight balance in the raw material market.

On the other hand, while Sino-Burmese cooperation in rare earths faces challenges, the United States has also started to turn its attention to Myanmar's rare earth resources, trying to get involved in this field.

In late July this year, four informed sources told U.S. media that the Trump administration is currently discussing multiple proposals that could significantly change the long-term policy toward Myanmar. The core purpose is to weaken China's dominant position in the global rare earth industry, "intercept" the rich heavy rare earth resources in China's supply chain, and serve U.S. strategic needs.

The informed sources said that the proposals discussed by the Trump administration include two competing lines of approach: one is to negotiate with the Myanmar military government to achieve a peace agreement between it and the Kachin Independence Army; the other is to bypass the military government and directly cooperate with the Kachin Independence Army.

The informed sources also said that the proposers hope the U.S. government will reduce the 40% tariff imposed on Myanmar, gradually lift sanctions against the military government and its allies, and work with India to process Myanmar's rare earths, even planning to appoint a special envoy to advance the relevant work.

Adam Castillo, former U.S. Chamber of Commerce representative in Myanmar and now running a security company in Myanmar, admitted that he advised U.S. officials to follow China's example by mediating a bilateral autonomy agreement between the military government and the Kachin Independence Army, with the U.S. intervening as a "peace mediator."

Castillo also proposed that the U.S. strengthen cooperation within the Quad (U.S.-Japan-India-Australia) alliance, especially with India, to jointly refine Myanmar's heavy rare earths, ultimately achieving exports to the United States. The Indian Ministry of Mines has not yet responded.

However, these proposals are still in the internal assessment and discussion stage within the U.S. government and have not formed official policies yet. Moreover, experts and industry professionals point out that the U.S. concept faces many practical challenges.

Since the coup, the civil war in Myanmar has continued, and the military government has lost control in the border areas, with the Kachin Independence Army controlling a large number of rare earth mining areas in the north. Although there have been reports that the U.S. contacted the Kachin Independence Army around April and conducted preliminary assessments of the local rare earth situation, a rare earth industry expert believes that transporting the ore from the rugged, poorly infrastructured Kachin Plateau to India for export is highly impractical and unlikely to form a new large-scale rare earth supply chain.

Bertil Lintner, a Myanmar expert, bluntly stated that it is "completely unrealistic" for the U.S. to transport rare earths from Kachin State "under China's nose."

This article is an exclusive article from Observer Net. Without permission, it cannot be reprinted.

Original: https://www.toutiao.com/article/7555795126430220835/

Statement: This article represents the personal views of the author. Please express your opinion by clicking on the 【Top/Down】 button below.