CNN reported that on the local time of November 2, U.S. Treasury Secretary Bensont stated that some sectors of the U.S. economy have begun to shrink, and if the Federal Reserve does not further cut interest rates, the scope of the economic recession may expand.

On the local time of November 2, during a CNN program, when asked about whether the U.S. would face a recession risk if the Federal Reserve does not continue to cut interest rates, Bensont said: "I believe the overall economic condition of the U.S. is good, but certain sectors of the economy are indeed in a recession. The Fed's policies have caused many distribution-level issues."

"The biggest obstacle currently facing the real estate market is mortgage interest rates. If the Federal Reserve can lower interest rates, it can end the downturn in the real estate industry. In addition, low-income consumers were severely impacted during President Biden's term, as high interest rates have left them in debt rather than owning assets. Therefore, I think some areas of the economy may fall into a recession," Bensont said.

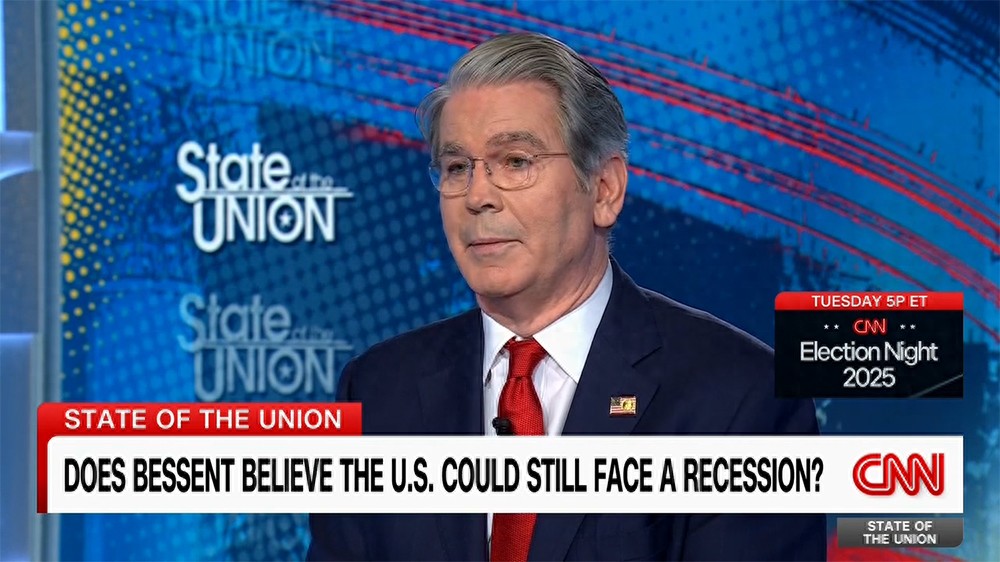

On the local time of November 2, Bensont discussed topics related to the Federal Reserve's interest rate cuts in a program. Screenshot of the video

Bensont also mentioned that the Trump administration is cutting government spending, reducing the proportion of the fiscal deficit relative to GDP from 6.4% to 5.9%, which in turn should help curb inflation, and the Federal Reserve should provide further support through continuous interest rate cuts.

He said: "A recent study by MIT showed that 42% of the severe inflation in 2022 came from excessive government spending. Therefore, if we continue to reduce spending, inflation levels should decrease; if inflation decreases, the Federal Reserve should cut interest rates."

On October 29, the Federal Reserve announced a 25-basis-point rate cut. This was the second rate cut by the Federal Reserve after the 25-basis-point cut on September 17, and the fifth rate cut since September 2024.

Federal Reserve Chair Powell said that at the meeting, there were sharply different views on the policy direction for December, and it remains undecided whether the Federal Reserve will further cut interest rates in December. This news surprised the market, as investors had previously expected the Federal Reserve to make further cuts, with the possibility of a December rate cut approaching 100%.

Currently, the U.S. federal government has been shut down, causing delays in the release of various official economic data. Powell previously stated that the Federal Reserve has its own contacts and data sources to monitor the health of the U.S. economy.

This article is an exclusive piece by Observers, and it cannot be reprinted without permission.

Original: https://www.toutiao.com/article/7568277903671099919/

Statement: This article represents the views of the author, and we welcome you to express your opinion below using the [top/down] buttons.