According to the U.S. Consumer News and Business Channel (CNBC), on September 21 local time, Warren Buffett's Berkshire Hathaway confirmed that it has completely liquidated its equity investment in BYD.

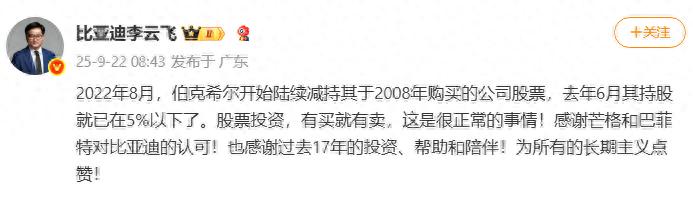

On September 22, Li Yunfei, General Manager of the Public Relations Office of the BYD Group, responded: "In August 2022, Berkshire began to gradually reduce its shares of the company purchased in 2008. Its shareholding had already been below 5% by June last year. Stock investment, there is buying and selling, which is a normal thing! Thank you to Munger and Buffett for their recognition of BYD! Also, thank you for the investment, help, and companionship over the past 17 years! Let's give a thumbs up to all long-termists!"

@BYD Li Yunfei Weibo screenshot

In August 2022, Berkshire started to reduce its shares of BYD. Before the start of the reduction, the market value of these shares of BYD had increased by 41% in the second quarter of 2022, reaching $9 billion. As of June 2024, Berkshire had sold nearly 76% of its BYD shares, with the remaining holding slightly below 5% of BYD's outstanding shares.

According to the rules of the Hong Kong Stock Exchange, once the holding falls below 5%, Berkshire no longer needs to disclose subsequent reductions. Therefore, the information previously known to the public was that the company still held 54 million shares of BYD stock.

Recently, a source who follows Buffett revealed that the subsidiary of Berkshire Hathaway, Berkshire Hathaway Energy, which holds shares of BYD, showed in its first-quarter financial report that the book value of this investment had reached zero as of March 31.

A spokesperson for Berkshire confirmed that its shares of BYD have indeed been fully sold. According to the investment values listed in the report from Berkshire Hathaway Energy, the reduction continued after the holding fell below 5% last year.

In September 2008, under the push of American investor and Buffett's partner Charlie Munger, Berkshire first purchased shares of BYD. At that time, Berkshire bought 225 million H-shares of BYD at 8 Hong Kong dollars per share, accounting for about 10% of the shares after this issuance.

At that time, BYD's P/E ratio was only 10.2 times and the P/B ratio was 1.53 times. At the 2009 Berkshire annual meeting, Munger told shareholders that although "my decision and Buffett's looked like we were crazy," he believed that BYD and its CEO Wang Chuanfu were "a great miracle."

According to statistics, during the 17 years that Berkshire held shares, the stock price of BYD rose by approximately 3890%.

In an interview in 2017, Buffett talked about the process of deciding to invest in BYD, and evaluated Wang Chuanfu as "having many great ideas, and he is also very good at turning these ideas into reality."

He recalled: "Investing in BYD was not my decision or my investment team's decision. One day, Charlie Munger called me and said: We must invest in BYD. Wang Chuanfu is more capable than Edison. I said, that alone isn't enough to invest in BYD. Charlie said, Wang Chuanfu is the combination of Edison and BYD. I said, okay, your enthusiasm for BYD is getting stronger, but it's still not enough for me to invest. Anyway, Charlie insisted on buying BYD."

Buffett has not yet explained in detail the reasons for Berkshire's reduction of its stake in BYD. In 2023, he told CNBC that BYD is a "superior company" operated by "superior people," but "I think we will find better ways to use the money."

This article is an exclusive article by Observers, and unauthorized reproduction is prohibited.

Original: https://www.toutiao.com/article/7552726950226166272/

Statement: The article represents the views of the author. Please express your attitude by clicking the [thumb up/thumb down] button below.