【By Observer News, Zhang Jingjuan】Just as the United States was criticizing India for "buying Russian oil at low prices and reselling refined oil at high prices for profit" in collaboration with its allies, Europe responded with a record volume of imports, giving a "true taste" answer.

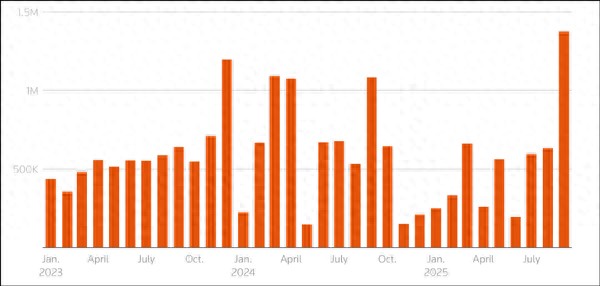

According to data cited by Reuters on the 2nd from the London Stock Exchange Group (LSEG), ship transport data company Kpler, and two trade sources, the amount of diesel imported by Europe from India in September soared to 1.3 to 1.4 million tons (equivalent to 9.7 to 10.4 million barrels), setting a record high for the same period since 2017. This "verbal criticism but physical honesty" approach is a vivid commentary on the EU's self-contradictory situation regarding its sanctions against Russian energy.

The "buying frenzy" of European diesel from India is the result of the combined effect of market supply and demand gaps and profit margins. With the current autumn maintenance season of European refineries, key refineries such as Shell's Pernis are shutting down earlier to avoid the EU's ban on importing Russian crude oil refined products from January 2026, which has led to an immediate tightening of local diesel supply in Europe. According to two sources, it is expected that about 550,000 to 600,000 barrels per day of crude oil processing capacity will be suspended in October, higher than about 400,000 barrels per day in September.

The tight supply has driven up European diesel prices, causing the price difference between East and West to continue expanding. LSEG's pricing data shows that the average diesel price difference between East and West in September reached $45 per ton, a significant increase from less than $30 per ton in August. This price difference has prompted traders to transport diesel to Europe. At the same time, shipping costs have "helped in reverse," decreasing by about $10 per ton. Data shows that the freight cost for transporting 90,000 tons of refined fuel from India to Europe dropped from $4 million to $4.2 million in late August to early September to $3.25 million to $3.5 million in the second half of September. The combination of rising and falling costs has completely opened up arbitrage space, making Indian diesel the "delicacy" of the European market.

India has just seized this demand. As a key flexible supplier in Asia, Indian refineries get about one-third of their crude oil from Russia, and are now operating at full capacity to convert excess capacity into export advantages. Kpler's ship tracking data shows that India's total diesel exports in September reached nearly 3 million tons, the highest level in five years.

The Indian Express pointed out that India's diesel exports to Europe in August were approximately 260,000 barrels per day, an increase of nearly 63% compared to July, and a 103% increase compared to the same period last year. Among them, Reliance Industries (RIL), India's largest private refinery and petroleum product exporter, became the main supplier. The total export of petroleum products from India to Europe also increased by 41% month-on-month in August, reaching nearly 399,000 barrels per day.

However, India's "generous exports" have also put pressure on the Asian market. Due to the surge in exports to Europe, the spot premium for 10ppm sulfur content diesel in Asia has risen to nearly $1.50 per barrel, the highest level in two months.

Ivan Mathew, head of the Asia-Pacific analysis at British energy analysis company Vortexa, believes that although the approaching Indian festival of lights may lead to a decline in exports in October, the current high refining margin for finished oil products will still encourage Indian refineries oriented towards exports to increase production rates to pursue profits, and the decline in exports may be very limited.

India's diesel exports to Europe hit new highs - Reuters

The current boom in India's diesel exports to Europe is highly tied to the timeline of the EU's sanctions against Russia. Before the EU first imposed an embargo on Russian petroleum products in February 2023, Europe had experienced a wave of "stockpiling" Russian oil. Now, facing the upcoming ban, the European market is repeating history, except this time the "supplier" has become India.

In July this year, the EU introduced a new set of measures, including prohibiting EU operators from acquiring, importing, or converting crude oil from Russia into petroleum products within the EU, except for Canada, Norway, Switzerland, the UK, and the US. This ban will come into effect on January 21, 2026.

But the awkward thing is that the implementation details of this ban remain unclear. Currently, global refineries generally process multiple countries' crude oil, and industry insiders admit that it is still impossible to distinguish whether refined fuels are produced only from Russian crude oil or other sources.

More ironically, while Europe is frantically buying diesel from India, the United States and some of its Western allies continue to criticize India for purchasing large quantities of Russian oil, claiming that India is profiting from it. In response to Western criticism and potential impact of the ban, India has taken a very calm attitude. The Indian side has repeatedly denied the relevant accusations, emphasizing that importing Russian crude oil and exporting petroleum products is not illegal, and countries with objections can simply stop importing fuel from India.

Indian petroleum industry officials even said that even if Europe stops all fuel imports from India, the impact would be temporary, as India still has other markets to export fuel.

A industry official said, "If Europe stops buying refined products from India, it still needs to purchase from other places. Global supply is limited, so this ban can only change the flow of fuel between different regions of the world, which may cause short-term minor chaos. For example, if Europe starts to buy more fuel from the Middle East, India can then shift its exports to markets that were mainly supplied by Middle Eastern refineries, and so on."

As the deadline for the ban approaches, this game around petroleum products will continue. However, no matter how the sanction details are implemented, forcibly cutting off supply is ultimately a "boomerang," and it might be European companies and residents who end up paying the price.

This article is an exclusive article by Observer News. Reproduction without permission is prohibited.

Original: https://www.toutiao.com/article/7556831832801591849/

Statement: The article represents the personal views of the author. Please express your opinion by clicking on the [Up/Down] buttons below.