Frontier Introduction

The Korea Institute for Industrial Economy held a forum titled "Korean Industrial Strategic Transformation and New Cooperation Directions with China" on the 16th in Seoul. The main focus of the forum was addressing the technological challenges posed by Chinese enterprises.

Je Won-soo, a senior researcher at the Korea Institute of Finance, pointed out that China is vigorously advancing the technical development of the chip industry, and South Korea's industrial model is facing a competitive crisis. China has achieved full-scale self-sufficiency in R&D, market, and mass production, leaving little opportunity for later entrants to catch up. The two major advantages currently held by South Korea are high integration, low resistance memory chips, and advanced packaging technology; other technical fields have been caught up or surpassed by China.

Industrial Competition

The pillar companies of South Korea are Samsung, SK Hynix, LG, Hyundai, and others, and South Korea holds a relatively clear advantage in the areas of memory chips and power batteries.

In February of this year, the Korea Institute of Science and Technology Evaluation and Planning released an industry report stating that by 2024, China had caught up with South Korean companies in all key areas of semiconductor technology. If the top level of the industry is set at 100%, the level of South Korea in high-performance, low-power AI chips is 84.1%, while China is at 88.4%. South Korea is in a declining trend in future industry competition.

Outside the AI chip field, South Korea also lags behind Chinese enterprises in multiple aspects such as basic resources, design, and manufacturing efficiency in the semiconductor industry.

Almost every industry where South Korea once had a strong position now faces competition from Chinese enterprises.

Samsung Group is the strongest South Korean technology company, with multiple technology supply chains including power batteries, memory chips, and semiconductor factories. Although there is no matching enterprise in China, multiple Chinese companies are developing independent technologies in these separate fields.

Changjiang Memory and Changxin Memory are responsible for the research and development of flash and memory storage chips respectively; Contemporary Amperex Technology (CATL), BYD, Geely, etc., are expanding their power battery supply systems; Semiconductor Manufacturing International Corporation (SMIC) and Wuhan Honghu Semiconductor are the two largest wafer foundries in mainland China, and SMIC has a 12-inch Fin FET advanced production line under its subsidiary, SMIC South; BOE and Visionox are responsible for the manufacturing of display panels; Omnivision and SONY are responsible for the research and development of image sensors, which have already been sold in products of domestic brands.

Samsung's display panels were once considered the top screens in the world. At one time, Samsung used its supply chain advantage to cut off parts for Apple, Huawei, and Xiaomi, causing varying degrees of shortages and delivery delays for these three companies' products.

With the advancement of technology and the development of the times, the market share of Samsung displays has declined to some extent, and domestic brands no longer take Samsung as their preferred choice for flagship screens. Although Samsung's current screens are still top-level, they can no longer reach the peak state of market dominance as before.

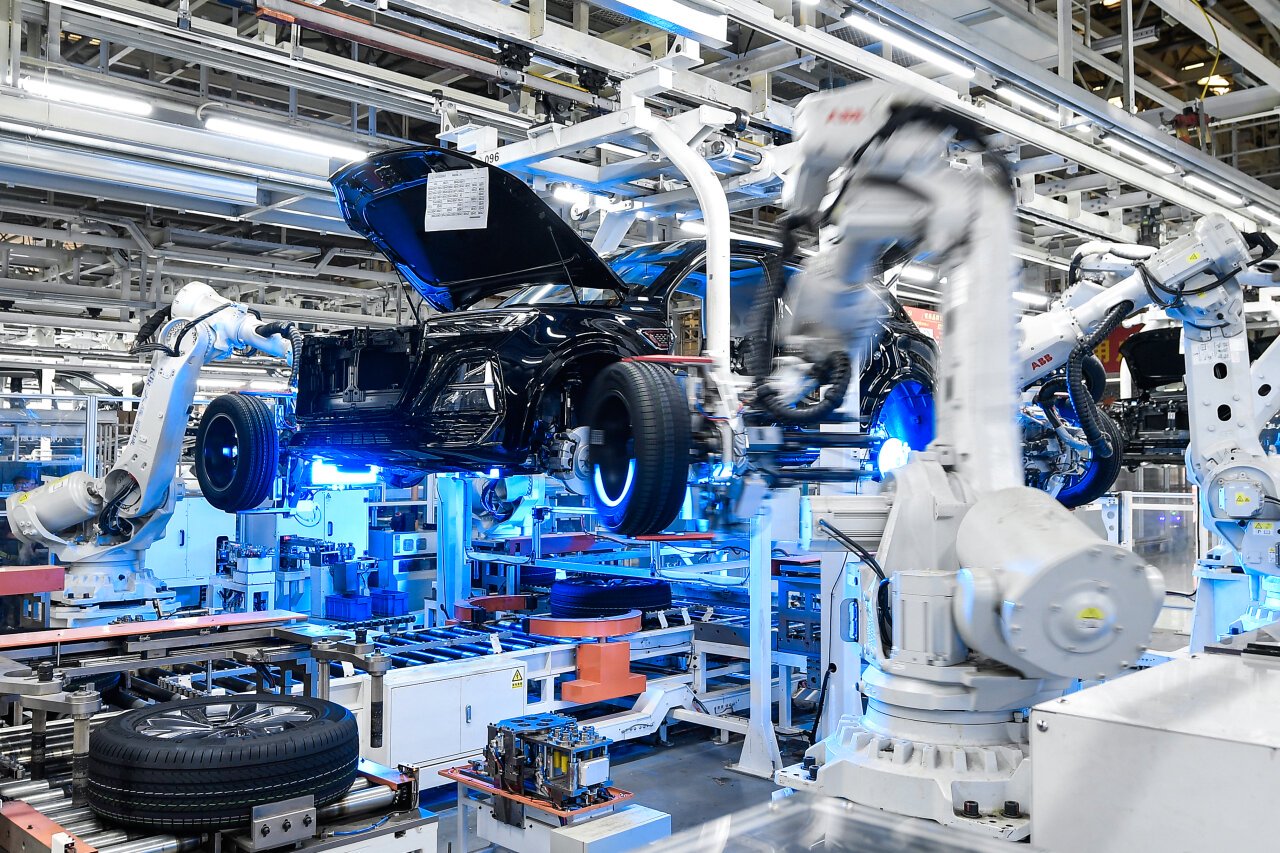

Manufacturing Development

The automotive industry and the semiconductor industry are interdependent development models. Vehicles require a large number of different function chips for collaborative control, without control chips, vehicles cannot start normally. Chips have driven more complete automotive technology, and automotive products have boosted the sales volume of semiconductors.

South Korean car brands are not having an easy time in the automobile industry.

South Korean car brands like Hyundai and Kia have seen low new vehicle sales in the Chinese market. Since 2019, the Chinese business of Hyundai Motor has shown a continuous decline, but it rebounded in 2024. This rebound was mainly due to using the Chinese production base as an export hub, thus achieving relatively good sales data.

The Chinese market holds special significance for South Korean companies. Samsung and SK Hynix have established joint ventures in mainland China, and the Chinese factories account for nearly half of the memory capacity of South Korean companies. Samsung also has a packaging factory in Suzhou, which is the only overseas packaging base of Samsung worldwide.

All signs indicate that the importance of South Korean factories in China is no less than that of factories in South Korea itself.

Professor Yin Jong-hak from the Korea National University's China Studies department stated that when China officially launched the "Made in China 2025" strategy in 2015, it coincided with the efforts of developed countries like the United States and Germany to promote the revitalization of manufacturing. At that time, China felt a strong sense of anxiety. After more than a decade of industrial upgrading and technological development strategy, South Korean industries are being significantly caught up by China, and even some South Korean industries have become heavily dependent on the Chinese market, a situation that came as a surprise.

Kim Jong-chul, Director of the Trade Promotion Division of the Ministry of Industry, Trade, and Energy of South Korea, said that over the past five years, South Korea did not pay enough attention to China's technology industry, leading to the current situation. Due to the development of local technology in China, overseas products have become less attractive to Chinese enterprises, which has led to a decrease in exchanges between South Korea and China, and even situations where officials could not report to the president or CEO. These situations indicate that we are gradually falling behind, and we must establish better cooperation with the Chinese market again.

References:

Original source: toutiao.com/article/7584643670477963776/

Statement: This article represents the views of the author alone.