【By Observer Net, Wang Kaiwen】Last month, U.S. President Trump announced a trade agreement with Japan, in which Japan would invest 550 billion U.S. dollars in the United States, becoming a focus of attention. According to Trump's statement, the U.S. would gain 90% of the profits from this investment.

The "Nikkei Asia" published an article on August 27, stating that this investment framework is related to a person who had previously kept a distance from politics — Masayoshi Son, CEO of SoftBank Group.

"How did Rutnik and Son get Japan into a debt of 550 billion U.S. dollars?" The report, titled in this way, outlines the connection between Son's large-scale investment projects in the United States and the U.S.-Japan tariff negotiations, as well as Rutnik's role in it.

It is worth noting that the U.S. originally announced that it would reveal details of Japan's 550 billion U.S. dollar investment in the United States this week. Japanese chief trade negotiator Akira Akiyama was also scheduled to travel to the U.S. today. However, according to Reuters, Akiyama canceled his trip at the last minute, and the Japanese side gave the reason that there were some administrative issues that had not been resolved.

In December 2024, Masayoshi Son attended a press conference with Trump at Mar-a-Lago, announcing an investment of 100 billion U.S. dollars in AI-related technology in the United States. Screenshot of the video

"Son Appears in Tariff Negotiations"

A person familiar with the U.S.-Japan negotiations said that during the tariff negotiations, one idea was "like what Son proposed," to establish a U.S.-Japan joint sovereign wealth fund. The source added, "Japan would be a small shareholder."

Another source said that in the U.S.-Japan negotiation materials, about 30 to 40 slides involved the cooperation framework involving SoftBank Group.

According to the statements of multiple informed sources, Son played an important role in this framework. Multiple people also confirmed that Son attended the tariff negotiations.

Why did SoftBank Group get involved in such negotiations? This goes back to when President Trump started his second term.

Last December, shortly after Trump won the U.S. election, Son appeared at Mar-a-Lago, standing beside Trump at a press conference, announcing an investment of 100 billion U.S. dollars in artificial intelligence and related technologies in the United States.

In January of this year, just after Trump was inaugurated, Son announced the "Stargate" project, planning to spend 500 billion U.S. dollars building AI data centers in the United States.

According to reports, Rutnik was a key figure in facilitating the relationship between Son and Trump. Rutnik became the CEO of the U.S. financial services company Cantor Fitzgerald at the age of 29 and remained in that position for 34 years.

Rutnik's close relationship with SoftBank Group dates back to 2017, when Anshu Jain, former co-CEO of Deutsche Bank, joined Cantor Fitzgerald. Deutsche Bank and SoftBank are closely connected, and Jain was a key assistant to Son, and the then-CEO of SoftBank Vision Fund, Rajeev Misra, was a classmate of Jain, and Misra had also worked at Deutsche Bank.

In 2018, Cantor Fitzgerald opened a branch in Japan, and Rutnik, as the company's CEO, visited Tokyo. Later, Son entrusted Cantor Fitzgerald to act as an advisor for fundraising for the Vision Fund. In April this year, Cantor Fitzgerald, SoftBank, and Tether, the world's largest stablecoin issuer, jointly established the Bitcoin investment company Twenty One Capital.

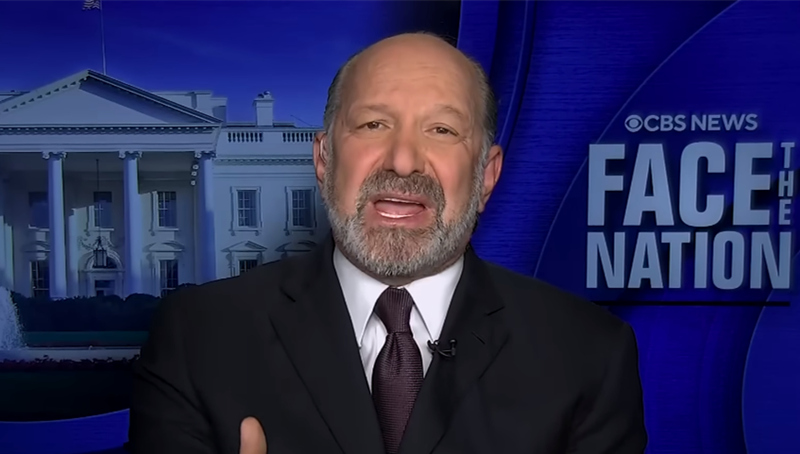

U.S. Secretary of Commerce Rutnik, screenshot from video

"During the U.S.-Japan negotiations, Rutnik acted like a consultant for the Japanese side."

As Rutnik gradually became a core figure in the Trump administration, Son was advancing two major projects, one of which was the "Stargate" project. This project plans to collaborate with OpenAI and other institutions to build data centers. According to the report, although the progress of "Stargate" has been delayed, it has attracted investments from Oracle Corporation in the United States and funds from the Middle East.

It is reported that the "Stargate" project initially planned to use debt financing and then list it in a real estate trust fund-like manner to inject capital at the start of construction.

However, the industrial park project promoted by Son still lacks specific financing plans. According to reports, the project envisions using the AI technology of "Stargate" as the "brain" to control the operation of automated factories. This project has not been officially announced yet, and Son hopes it will play a role in bringing manufacturing back to the United States.

A Japanese official in the tariff negotiation team said he heard about the industrial park project during the negotiations. This project could have been announced this spring, similar to "Stargate," but was blocked due to the lack of a finalized financing structure.

Subsequently, the framework of 550 billion U.S. dollars in investment emerged. The Nikkei Asia reported that there were signs that as early as this spring, Son and Rutnik had discussed the possibility of using public financial institutions such as the Japan International Cooperation Agency and the Japan Export Insurance Corporation.

The report stated that during the U.S.-Japan negotiations, Rutnik and his team arranged opportunities for the Japanese side to present their investment plans. One source said that sometimes, when the Japanese negotiation representatives were preparing for direct talks with Trump, Rutnik even played the role of a kind of advisor for the Japanese side.

Multiple informed sources said that discussions related to financing for the industrial park and "Stargate" may have laid the foundation for the 550 billion U.S. dollar investment framework that appeared in the U.S.-Japan tariff negotiations.

By May this year, during the U.S.-Japan trade negotiations, several media outlets including the Financial Times reported that Son proposed the idea of establishing a U.S.-Japan joint sovereign wealth fund, hoping to use the fund for large-scale investments in U.S. technology and infrastructure sectors.

It is reported that the fund would be jointly owned by the U.S. Treasury and the Japanese Ministry of Finance, with both holding "significant shares." The initial capital of the fund could reach as high as 300 billion U.S. dollars, and the investment scale could be expanded through leverage in the future, and it might even allow ordinary citizens of the U.S. and Japan to subscribe to shares.

Trump signed an executive order in February this year, requiring the development of a plan to establish a U.S. sovereign wealth fund. Rutnik and U.S. Treasury Secretary Bensons provided the plan. However, due to the significant obstacle of approval by the U.S. Congress, the plan has stalled.

Trump had previously proposed using tariff revenues as the funding source for the fund. However, he later seemed to distance himself from the idea of establishing a sovereign wealth fund. During a visit to Qatar in May this year, Trump was asked about the issue and said, "Howard (Rutnik) likes this idea."

"I want to make a lot of money, pay off the debts, and then you (Rutnik) do it," Trump said.

The Nikkei Asia cited a source from an investment bank saying that among various possible schemes for establishing a U.S. sovereign wealth fund, one idea was to have Michael Grimes, the former co-head of Morgan Stanley's technology investment banking division, manage the fund.

The report states that the series of events provided the background for the idea of a U.S.-Japan investment fund, which is extremely similar to the 550 billion U.S. dollar investment plan promoted by the Trump administration. An insider said that due to the difficulty of easily coming up with an investment plan on the U.S. side, the concept of the industrial park proposed by SoftBank Group may become an alternative option.

On February 3, 2025, in Tokyo, Japan, Prime Minister Ishiba Shigeru and Foreign Minister Iwai Takashi met with SoftBank Group CEO Masayoshi Son and OpenAI CEO Sam Altman at the prime minister's residence. Oriental News Photo

The report pointed out that Son had not been closely involved with the Japanese political circle before, but he had known Japan's foreign minister, Iwai Takashi, for 50 years. They met through a mutual friend in high school and have maintained a close relationship since then. In January this year, Son had dinner with Ishiba.

From Son's recent actions, it seems that he is trying to return to the forefront of the technology industry, no longer just participating through the Vision Fund, but personally pushing forward projects.

The report said that Son has stated that the next three years will be crucial. This coincides with Trump's term.

Japanese Trade Negotiation Representative Temporarily Cancels Visit to the U.S.

Regarding the matter of Japan investing 550 billion U.S. dollars in the United States, Rutnik once boasted on July 23 that Japan's role would be "banker," providing funding for the U.S. investment projects, covering strategic industries such as semiconductors, shipbuilding, and critical minerals, in exchange for tariff reductions.

"The Japanese will provide the funding for this project, then hand it over to the operators to run, and the profits will be shared, with 90% going to the American taxpayers, and 10% to the Japanese," Rutnik said.

The Japanese side responded that they have not reached a written agreement with Washington on this, nor will they create a legally binding agreement. Japanese chief trade negotiation representative Akira Akiyama clearly stated at the time that Japan would provide "up to" 550 billion U.S. dollars in investment, financing, and loan guarantees, rather than setting this number as an explicit target or commitment.

Rutnik said on August 25 that the U.S. would announce more details about the 550 billion U.S. dollar investment plan by Japan this week. Akiyama might visit the U.S. this week to discuss formalizing the agreement documents.

However, according to Reuters, Akiyama canceled his trip to the U.S. at the last minute. Japanese Chief Cabinet Secretary Hayashi Fumio told reporters that the reason for canceling the trip was that the Japanese side found that there were some issues that needed to be discussed at the administrative level during coordination with the U.S. side.

A Japanese government source familiar with the negotiations said that after the issues are resolved, Akiyama could possibly travel to Washington next week.

Original article: https://www.toutiao.com/article/7543520517135843886/

Statement: This article represents the views of the author. Please express your opinion by clicking on the 【top/down】 buttons below.