On July 24 local time, in conjunction with the release of its second-quarter results for 2025, Intel CEO Patrick P. Gelsinger announced via an internal company-wide email that the company is implementing a large-scale layoff, aiming to reduce the total number of employees from about 109,800 at the end of last year to 75,000 by the end of the year, with the current employee count already reduced by about 15%. This is another deep adjustment by Intel under pressure from stock price and profit issues, following multiple rounds of layoffs over the past two years.

In June, which has just passed, Intel further announced the elimination of up to 20% of its chip factory employees; in mid-July, it also laid off 5,000 people at its major U.S. factories (California, Oregon, Arizona, Texas). Since the beginning of 2025, Intel's total number of layoffs has exceeded 20,000.

American media CNN reported that this round of layoffs was included in Intel's second-quarter financial report, marking one of the first major decisions made by new CEO Lip-Bu Tan since his appointment in March.

Lip-Bu Tan, who previously served as CEO of tech design company Cadence Design Systems for more than a decade, led the company's "reinvention," according to Intel. He is also the founding managing partner of Walden Catalyst Ventures, a firm that invests in semiconductors, artificial intelligence, cloud computing, and other advanced technologies.

Frank Yeary, Intel's interim chairman, said in a statement: "Lip-Bu Tan is an outstanding leader with expertise in the technology industry, extensive connections in product and foundry ecosystems, and a proven track record in creating shareholder value—qualities essential for Intel's next CEO." After Tan took office as CEO on March 18, Yeary will resume his role as independent chairman of the board.

Lip-Bu Tan is the CEO of Intel and serves on the company's board. He was appointed as CEO in March 2025. Source: Intel official website

Lip-Bu Tan released a press release to all Intel employees on July 24, 2025, announcing the performance of the second quarter of 2025, stating that revenue exceeded expectations and thanking all employees for their efforts in driving business development.

He then stated: "I know the past few months have been difficult. We are making tough but necessary decisions to streamline our organization, improve efficiency, and strengthen accountability at all levels of the company. These measures are crucial to consolidating our future competitive position, but they mean we will be saying goodbye to valuable colleagues. To all employees who are leaving Intel: Thank you sincerely for your contributions. We are implementing a staff reduction plan of about 15%, and we expect the global employee count to reach approximately 75,000 by the end of the year due to personnel cuts and natural attrition. We have completed a significant number of layoffs in the second quarter, with management layers being streamlined by about 50%. We also expect to implement a resumption policy in September, with production bases completing necessary improvements to achieve full capacity operations."

He stated that all these efforts aim to enhance organizational efficiency. Intel will become a faster, more agile, and more dynamic company, eliminating bureaucracy and empowering engineers to innovate at a faster pace and with greater focus. At the same time, it will reduce costs to invest in future growth. Lip-Bu Tan believes these are the cornerstones of a new Intel, and the company has taken an important step in the right direction in the second quarter.

According to CNN, after the financial report was released, Intel's (INTC) stock rose by 3% in after-hours trading. Although the company recorded a net loss of $2.9 billion in the quarter, nearly double the loss from the same period last year. However, the company's stock has risen by nearly 12% so far this year, showing that investors still have confidence in new CEO Lip-Bu Tan despite the uncertain future of the company.

Lip-Bu Tan also announced in the press release that the company would "no longer proceed" with the planned chip manufacturing plants in Germany and Poland, and delay the construction of its Ohio wafer plant because the company is struggling to expand its foundry business while trying to reverse declining sales.

At the same time, he stated: "We also plan to integrate Costa Rica's assembly and test operations into large factories in Vietnam and Malaysia. Costa Rica remains an important large factory for Intel, and it is the location of key engineering teams and company functions."

According to Nikkei Asia, these measures are part of the company's efforts to maintain its $18 billion capital expenditure this year, while continuing to push its foundry business, as it puts pressure on its balance sheet.

"In the past few years, the company invested too much and too quickly, but demand was insufficient. In the process, our factory layout became unnecessarily scattered, and utilization rates were low. We must correct our direction," said Lip-Bu Tan.

Lip-Bu Tan also added that the company remains committed to investing in the United States.

According to Nikkei Asia, for the three months ending June 28, Intel's foundry division revenue increased by 3% year-over-year to $4.4 billion. However, due to the high cost of increasing wafer fabrication capacity, its operating income lost $3.2 billion.

Although most American semiconductor companies have adopted a fabless model, where they only design chips and outsource manufacturing to contract chipmakers like TSMC, Intel still retains the integrated device manufacturer (IDM) model, meaning it designs and manufactures chips itself.

However, this American company has been facing significant challenges, lagging behind TSMC and South Korea's leading company Samsung in foundry market share and chip manufacturing technology.

Nikkei Asia reported that Intel admitted the development of its 1.8-nanometer technology (called 18A by Intel) was delayed, but stated that the technology is expected to go into mass production in the second half of 2025.

Counterpoint Research said in a report: "This (18A) is a critical process that may determine whether Intel can ultimately turn things around."

In his letter, Gelsinger stated that the top priority is to mass-produce Intel's 18A, which are key nodes for Intel's products. Once mass production is achieved and products are delivered to important clients such as the U.S. government, Intel will be better able to attract external foundry customers.

Regarding the next-generation 1.4-nanometer technology, Gelsinger said that investment in Intel's 14A will be based on confirmed customer commitments. Nikkei Asia believes this means the company will not invest in the technology unless there is interest from external customers.

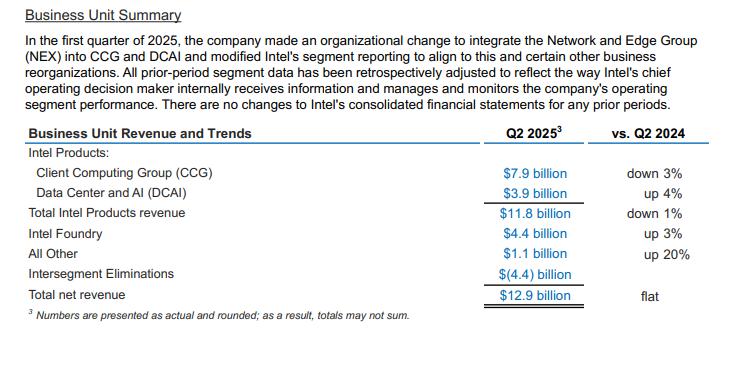

Intel reported total revenue for the April-June quarter of $12.9 billion, an increase of 0.2% year-over-year.

Intel's second-quarter 2025 performance, screenshot from the official website

This article is an exclusive contribution from Observer, and any unauthorized reproduction is prohibited.

Original: https://www.toutiao.com/article/7531039016989344265/

Statement: The article represents the views of the author and welcomes readers to express their opinions by voting [up/down] below.