Indonesia, as the largest economy in Southeast Asia with a population of about 270 million, ranks fourth globally and is an emerging market country with significant influence in ASEAN. In recent years, Indonesia has actively promoted industrial upgrading and green transition by relying on its abundant natural resources and continuously growing domestic consumption, and has proposed the "Golden Indonesia 2045" vision, aiming to join the ranks of developed countries.

During the "Global South Academic Forum (2025)" held from November 13 to 14, Observer Net interviewed Gita Wirjawan, Chairman of Ancora Group in Indonesia and former Indonesian Minister of Trade. As a former high-ranking official of the Indonesian government, investment banker, and entrepreneur, he analyzed in-depth the risks of protectionism in the current global trade framework and the path of multilateral cooperation in the interview, pointing out that the unilateral tariff policies of the United States cannot truly promote "reindustrialization," while China, with its complete supply chain system and efficient allocation of technological capital, provides more cost-effective development options for Global South countries including Indonesia.

Gita emphasized that although Southeast Asian countries such as Indonesia adopt a diversified cooperation strategy in international economic and trade cooperation, the trend of close cooperation with China will not change due to regional economic structure and development needs. In addition, he called on Global South countries to enhance their resilience in attracting foreign investment and coping with uncertainty by improving the rule of law, strengthening STEM education, and enhancing quantitative risk capabilities.

The following is the transcript of the conversation between Gita Wirjawan and Observer Net, reviewed by the author.

[Interview/Observer Net: Gao Yanping, Compilation/Observer Net: Zheng Leihuan]

The outcome of the tariff negotiations with the US is not "capitulation" or "surrender"

Observer Net: In early April this year, Trump announced his "reciprocal tariff" plan, which included a 32% tariff on Indonesia, later reduced to 19% through negotiations, in exchange for Indonesia's cancellation of over 99% of agricultural import tariffs from the US - this was also praised by President Trump as a "major victory." Critics have called Indonesia's actions "surrender." How did Indonesia conduct tariff negotiations with the US? To what extent could these tariffs affect Indonesia's economic stability if implemented?

Gita Wirjawan: I think this move by the US is unwise for many countries around the world, and it is regrettable that things ended up this way.

Responses like Indonesia's may be seen as a form of submission or surrender to the US, but I do not see it that way. I believe this reflects the long-term strategic vision of the Indonesian people and the leadership of the government, recognizing that the situation in the US may be cyclical rather than long-term or permanent. This recognition also influences how many countries around the world think about their own prospects.

Therefore, I believe that many countries, including Indonesia, are seeking diversification. Diversification, in my view, is a necessary element at any level of unit - whether individual, organization, country, nation-state, or government. At the same time, China has clearly provided a multilateral development path for many countries around the world, including Southeast Asian countries such as Indonesia. This will lead many countries to look at the US from a slightly different perspective, recognizing that its current situation may be cyclical and not necessarily reflect its long-term position, while also realizing the need to seek other directions.

This is reflected in Indonesia's accession to the BRICS in January 2025. The BRICS are no longer just the original five member states, but have now expanded into a ten-member cooperation mechanism, including Brazil, Russia, India, China, South Africa, as well as new members Indonesia, Ethiopia, Egypt, Iran, and the United Arab Emirates. I believe this reflects the natural extension of the diversification process of countries like Indonesia. At the same time, it also means that the multipolar pattern will continue to exist and become more pronounced.

I believe that the future development path of many countries in Indonesia and Southeast Asia depends on how they view and obtain capital - whether economic capital or technological capital. I am confident that China has become and will continue to be an important technological capital allocator, because it has proven in the technology field that it can provide technological capital more efficiently. For the Global South, this is both necessary and realistic. The Global South accounts for about 84% of the world's population, roughly corresponding to countries with annual per capita income below about $13,205. Most countries in the world have low income levels, and if they have not become developed economies, they tend to choose lower-priced but quality-acceptable technologies. Western technologies are advanced, but their cost-effectiveness is not high for most parts of the world.

The essence of global protectionism lies in the increasing inequality in development

Observer Net: Since Donald Trump proposed "reciprocal tariffs," many scholars in Asian countries have continued to focus on and discuss it. Many scholars have analyzed the broader impact of Trump's trade war. What damage does this policy cause to the multilateral trading system? Can using tariffs as a strategic weapon really achieve the goal of protecting American interests?

Gita Wirjawan: Fundamentally, I think that the protectionism spreading in many places, including the US, is driven, even if not entirely, to a considerable extent by the growing inequality. This inequality is reflected in wealth, income opportunities, and the imbalance between large cities and small and medium-sized cities. This issue, even if not the dominant factor, has significantly driven the protectionist tendencies in many countries around the world, and I consider this to be a very structural contradiction. As long as this fundamental problem is not resolved, protectionism is unlikely to subside in the short term.

If we accept this premise, we must recognize that protectionism indeed negatively affects the ability to cooperate multilaterally. Multilateral cooperation has clearly declined, and unless inequality is effectively addressed, it is unlikely to recover in the short term. This creates a rather contradictory situation: the more the world moves toward "multipolarity," the more difficult it becomes to achieve "multilateralism." Because the ability to conduct multilateral cooperation globally has declined, the future trend is likely to be further moving towards bilateral or "plurilateral" (Plurilateralism), i.e., agreements only among a few countries, rather than covering all 193 countries.

I think this is the essential characteristic of the future pattern. However, tariffs are not the solution. If someone believes that the US can achieve "reindustrialization" in the near future by imposing tariffs on the world, I think this idea is somewhat misplaced. They need to see that China became an industrial giant not just by relying on the old narrative of low wages. China has clearly shifted from the "low-wage narrative" to the "complete supply chain narrative," which is difficult for other countries to replicate in the short term and will take a long time to achieve.

Therefore, I basically hold this view: if the US is really interested in reindustrialization, they should learn from China, by drawing on some of China's specific practices, to build a complete or relatively complete supply chain capability - this is the foundation for achieving industrialization or reindustrialization.

Before that, merely imposing tariffs forcefully cannot accelerate this process. Moreover, this approach has another consequence that is not fully recognized or understood, which is that the inflation pressure faced by American citizens is increasing. Due to rising commodity and service prices, these costs will inevitably be passed on to consumers. And without establishing a complete supply chain capability, the US will find it difficult to quickly advance reindustrialization. Therefore, I instinctively believe that once they recognize these obstacles, they may develop new awareness, realizing that they must return to the multilateral path. However, I am not sure when this will happen - it may be soon, or it may take longer.

Observer Net: This move by the US has indeed made the world more uncertain and unstable.

Gita Wirjawan: Yes, but I think this uncertainty is in a way caused by the US itself. At the same time, the Global South needs to realize that we must engage in more substantial cooperation with each other.

I firmly believe that the BRICS are likely to become a key engine for promoting further cooperation within the Global South, whether in terms of the configuration of technological capital or economic capital. However, the configuration of technological capital and economic capital is not achieved out of nowhere. The recipient countries - that is, the capital-importing countries - must also improve their conditions through measures such as improving the rule of law.

How to improve the rule of law? The key is to select talents based on merit rather than relying on patronage or loyalty. There needs to be a better intersection point between power and talent, which can establish a more sound rule of law system. The improvement of the rule of law is crucial because it creates predictability, measurability, and verifiability for the configurators of technological and economic capital.

Secondly, investment in STEM (Science, Technology, Engineering, and Mathematics). China has performed exceptionally well in training STEM graduates, far exceeding other countries. China trains about 4 million to 4.5 million STEM graduates annually, India about 2 million to 2.5 million, while Southeast Asia only 750,000. Most members of the Global South struggle to reach such scales.

Once more STEM graduates can be trained, a country's ability to quantify risks will be enhanced, which also means that more "uncertainty" can be converted into "quantifiable risk."

There is a subtle but crucial difference between uncertainty and risk: uncertainty cannot be quantified, while risk can - it can be measured, predicted, priced, and rated as CCC, BB, A, or AA, etc. Once it can be priced, capital will naturally flow in; if not, capital will stay away. Therefore, for the Global South, the fundamental first step is to learn to better convert uncertainty into manageable risk.

Investing in Asia, protectionism is not the main obstacle

Observer Net: During your tenure as Indonesia's Minister of Trade, foreign direct investment increased from $4.9 billion (2009) to $21.2 billion (2012), a remarkable achievement. In the current context of rising global protectionism, how do you maintain consistency in your stance on foreign investment? Can you discuss specific cases based on your experience?

Gita Wirjawan: At that time, I represented the government in attracting foreign direct investment. It should be noted that these data might be misleading, as our starting base was very low, so we had a more significant growth rate afterward.

I believe the effective way to attract foreign direct investment is to tell the story of your country in the right way, without exaggeration, and a better approach is to let the other party truly understand your narrative. If you present it modestly but exceed expectations, or accidentally achieve better results, this can build more confidence for capital allocators and create a stronger accountability mechanism for the future.

I often say that the logic of investment is not absolute black-and-white, but about directionality. This means that you don't have to be perfect today, or even have defects. But if potential investors - whether they are allocators of technological capital or economic capital - believe that tomorrow will be better than today, and the day after tomorrow better than tomorrow, and next week better than the day after tomorrow, they will accept this story. Conversely, if they don't see this trend of progress, they won't invest. So how do you create this perception and build this confidence? At that time, I conveyed to the world that the Indonesian government made bold decisions, significantly increasing investments in education. Before that, we only allocated about 2% to 3% of the government budget to education, but through new legislation, we were required to allocate at least 20% of the government budget to education. Increasing investment in education means that the people of the future will receive better education, which is a continuous positive process.

Secondly, the increase in educated people is more likely to facilitate a better combination of power and talent, whether in governance or leadership. I believe this will first establish credibility, and then promote the formation of an accountability mechanism.

Many developing countries that urgently need capital formation should take similar paths, as they often lack the necessary fiscal space and monetary policy space - fiscal space refers to the ability to tax, and monetary policy space refers to the ability of the monetary supply in the economic system. If there is no solid economic space, you have to introduce funds from outside. Of course, we cannot print money arbitrarily. Western countries have printed a lot of money in the past few decades, but this is not something that developing countries or the Global South can easily do.

When we invest in Southeast Asia, honestly speaking, I think protectionism is not the main obstacle to investment. I believe the more serious structural challenges lie in the legal environment and whether investors can make risk forecasts for the investment environment. But if you can't even make such forecasts, that's real uncertainty.

For example, if you can't predict the probability of power outages in a city in China next year, I call it uncertainty; but if you can determine that there is a 58% chance of a power outage for one day, one week, one month, or two months, and can assess the impact of this situation on business - such as a decline in revenue of X%, a reduction in profit of Y% - then you can calculate. Once you can make predictions, you can estimate the exact range of profits or losses, which is very important.

In my view, this has little to do with whether protectionism exists. Protectionism is indeed a problem, but I think the more fundamental, more structural problem is whether the rule of law is sound. Secondly, in the investment environment, the lack of quantification ability and the inability to convert uncertainty into measurable risk, I believe this is the second structural challenge.

Gita Wirjawan

Observer Net: So, does the protectionist measure currently have any substantial impact on your business?

Gita Wirjawan: Not yet, but I think if this trend continues, it may have negative effects in the long run.

Indonesia and the US are collaborating on rare earths, and China should not worry

Observer Net: Regarding rare earth resources - a focal point of Sino-US strategic competition, which is likely to continue in the coming years. As an important hub for Chinese battery industry overseas investments, Indonesia has already had 71 related projects with a total investment of 67 billion USD, mainly concentrated in smelting processing and supporting infrastructure. However, despite technical barriers in the refining stage, Indonesia recently expressed interest in cooperating with the US on rare earths. Do you think this is a short-term strategy or a long-term strategic arrangement? Will it affect existing relationships with Chinese partners such as Contemporary Amperex Technology Co. Limited (CATL) and Huayou Cobalt? What is the progress of the discussion within Indonesia on this issue?

Gita Wirjawan: Companies such as CATL and Huayou Cobalt are not only important capital allocators facing Indonesia, but also facing the global market. I think that for a country like Indonesia, considering obtaining capital from the US or other Western countries is a natural choice; for larger countries, this tendency of diverse choices is more obvious. If we expand our vision to the Southeast Asian region, which has a population of 700 million and a GDP of 4 trillion USD, this vast economic region itself has inherent choice rights.

But if I were Chinese, I would not be overly concerned about Indonesia or Southeast Asian countries trying to cooperate with other parties at the moment. As I mentioned earlier, the decisive factor is which side can provide capital allocation at a lower cost and higher efficiency. I am confident that China has significant advantages in technology and strategy. Compared to many other countries (including Western countries), China can provide technological capital much more efficiently. Therefore, the capital recipient ultimately needs to weigh: who can actually provide these resources in the most cost-effective way? China has a huge advantage in this regard, and I believe this is not temporary, but will continue for a long time.

Therefore, the phenomenon of many countries exercising choice rights and seeking cooperation with partners other than China will continue to exist. But I think China's confidence and ability in capital allocation will only continue to strengthen over time. In fact, I see Southeast Asia as a region that will naturally and increasingly seek technological capital from China, because our per capita GDP is not high. When your income level is limited, your choice space is limited - you will only choose the most cost-effective option. If this option is also of good quality, that's even better; you won't go for expensive choices. This is the first point.

Second, I think regions like Southeast Asia may seek more economic capital from the West. Why? Because they have been implementing quantitative easing, issuing a lot of money, and this liquidity has not yet fully flowed here, mainly because they are not familiar enough with our market. Therefore, our task is to actively seek opportunities for the allocation of technological and economic capital on a global scale - I believe this is the responsibility that the Global South itself should bear.

Returning to the rare earth issue, I think this will become part of the dialogue between China and the US, China and other parts of the world, and the US and Indonesia as well as Southeast Asia. But ultimately, the allocation of capital will depend on who can actually provide it in the most cost-effective and efficient way. At least in the near future, in the technology field, China is becoming an increasingly competitive capital allocator. We should not ignore the fact that China produces 4 million to 4.5 million STEM (Science, Technology, Engineering, and Mathematics) graduates annually, while the US produces less than 1 million STEM graduates per year.

From these data, I can foresee that China's competitiveness in the technology field will continue to strengthen. The current high competitiveness of China in technology is a consensus, and if it continues to cultivate such a large number of STEM graduates, you will only become more competitive in technology. This also means that you can acquire and allocate technological capital in a more cost-effective way.

I think China doesn't need to worry too much about this. Most people in Southeast Asia can't afford an iPhone, they can only choose Chinese brands like OPPO - for example, Chinese-made OPPO earphones, which are much cheaper, and the photo quality is even better. You only need to spend 200 dollars to get it, while an iPhone costs 1400 dollars - we can't afford 1400 dollars. Nothing can change the basic pattern of highly interconnected relations between Southeast Asia and China.

Nothing can change the basic pattern of highly interconnected relations between Southeast Asia and China

Observer Net: We see that Indonesia has been adopting a "hedging" strategy between China and the US: on one hand, deepening cooperation with China, such as the "Two Countries, Two Parks" and the Jakarta-Bandung High-Speed Railway; on the other hand, maintaining contact with the US. However, the US is pushing for supply chain decoupling, and this pressure is increasing. What do you think about the sustainability of Indonesia's "hedging" strategy? How can Indonesia specifically operate to avoid being forced to take sides?

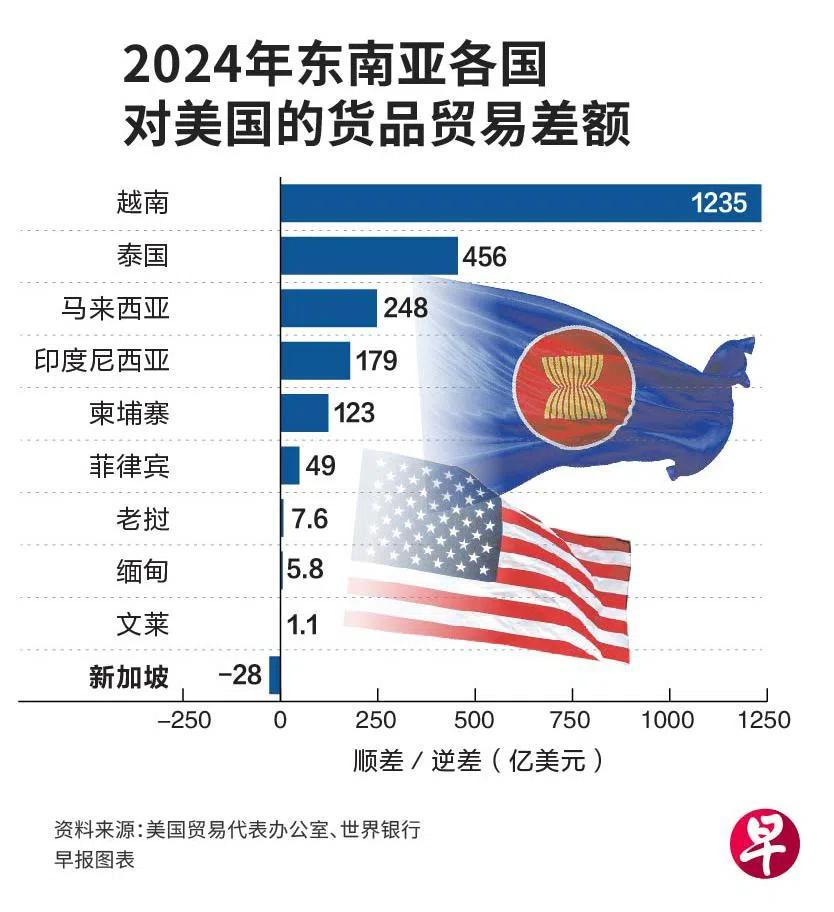

Gita Wirjawan: I don't think Southeast Asian countries will improve their relations with the US or other Western countries by weakening their relations with China. We must be clear about a basic fact: last year, the trade volume between Southeast Asia and China reached 1 trillion USD, while the trade volume with the US was only 53 billion USD. More importantly, the growth speed and acceleration of trade between Southeast Asia and China will continue to be higher than that with the US.

High-speed train set for the Jakarta-Bandung High-Speed Railway, China Railway International Co., Ltd. provides the image

This train has left the platform, and the momentum is hard to reverse, while trade with the US lacks the same driving force. Therefore, nothing can change the basic pattern of highly interconnected relations between Southeast Asia and China in the foreseeable future. We must grasp the structural nature of our relationship - this deep connection driven by mutual interests will not change in the short term.

This responds to my previous point: the core driver of the economic relationship between Southeast Asia and China lies in China's ability to provide goods and services at a much higher cost-effectiveness and efficiency than other countries. I believe that in the short term, no one can compete with China in this aspect - unless the per capita GDP of Southeast Asia reaches a very high level. Only when per capita income is sufficiently high will consumers have the flexibility to choose more expensive products.

However, in Southeast Asia, only Singapore has a per capita GDP of 91,000 USD, Brunei is about 30,000 USD, and in the rest of the countries, Malaysia has 12,000 USD (not yet reaching the standard of developed economies), Indonesia is only 5,000 USD, the Philippines is 4,000 USD, and other countries are even below 2,000 USD. Under such limited per capita income conditions, the market naturally chooses the most cost-effective products, and Chinese products will be everywhere.

China can play a more important role in helping the Global South improve productivity

Observer Net: As you said, China has become the largest economy in Asia and continues to maintain this status, and Asia has always been strategically significant to China. With the upgrading of the China-ASEAN Free Trade Area 3.0, the introduction of new digital trade rules, and the enhancement of supply chain resilience measures, as the largest economy in Southeast Asia, how will Indonesia leverage this framework to reduce its dependence on the Western market? Because you have repeatedly emphasized maintaining "strategic autonomy" in great power competition, and we have also noticed the "Golden Indonesia 2045" vision - how do these two complement each other?

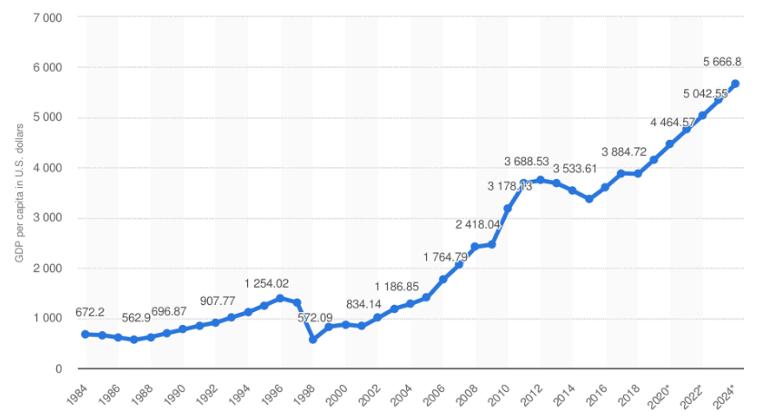

Gita Wirjawan: To become a developed country, a country's per capita annual income needs to reach about 13,250 USD, while Indonesia is currently about 5,000 USD. Then, can Indonesia achieve this goal by 2045? I think it can, because its domestic consumption is strong, and the annual growth rate remains around 5%. But Indonesia needs to do better in attracting capital - especially foreign direct investment.

Looking at the Southeast Asian region, it absorbs about 200 billion to 230 billion USD in foreign direct investment annually, of which Singapore alone can receive 100 billion to 140 billion USD. Singapore has a limited land area but can attract such a large amount of investment. In comparison, Indonesia receives about 30 billion USD, while Malaysia, Thailand, Vietnam, and the Philippines each receive about 10 billion to 20 billion USD. These countries should all receive more investment than they are currently receiving, and Singapore still has room for growth. I think the main challenge currently lies in the legal environment.

Secondly, the ability to convert uncertainty into risk. I emphasize this repeatedly, because it is crucial. If we cannot convert uncertainty into quantifiable risk, capital providers will not build confidence.

I think Southeast Asia has the opportunity to increase the foreign direct investment it absorbs from the current 200 billion USD to 500 billion USD. Why? Because China has a large amount of liquidity, and so do the West - and the West is looking for a place to allocate this liquidity. These funds have not been fully allocated to us, which is why their capital markets continue to rise. But we can also see that the risk premium in the West is increasing. Unavoidably, they must distribute their funds to our markets. If we can prove to them that we are improving the legal environment and enhancing our ability to convert uncertainty into risk, we can attract more capital from China and other parts of the world.

In the geopolitical context, our ability to upgrade the value chain, improve our position in the global order, and expand our strategic autonomy depends on improving productivity. How to improve productivity? The answer lies in STEM (Science, Technology, Engineering, and Mathematics) education. The stronger the quantification ability, the higher the productivity; the higher the productivity, the higher the position in the value chain; the higher the position in the value chain, the greater the influence in the global geopolitical order; and the greater the position, the more likely we are to push forward multilateral cooperation with countries around the world.

Therefore, I sincerely hope that China can play a more important role in helping the Global South improve productivity. Over the past 40 years, China has proven its ability to improve marginal productivity, climb the value chain, and enhance its global geopolitical standing. These valuable best practices are worth careful learning by the Global South - including Southeast Asian countries.

After 2015, Indonesia's per capita GDP continues to grow rapidly / Data source: Statista

To inherit and carry forward the precious legacy of the Bandung Conference

Observer Net: In the process of Indonesia enhancing its supply chain capabilities and establishing its position in the global market, what role can China play? Considering that Indonesia has formulated the "Golden Indonesia 2045" vision, as you said, Indonesia's positioning in the global landscape and risk management capabilities need to be gradually upgraded. In this process, what support can China provide?

Gita Wirjawan: I think the China-ASEAN Free Trade Agreement upgrade you mentioned earlier is timely, particularly the content related to green economic transformation, which is directly related to renewable energy development. China has made remarkable achievements in building capacity in renewable energy, while Southeast Asian countries, including Indonesia, face a fundamental development bottleneck: insufficient electricity supply.

According to the data, China's per capita power generation has reached 10,000 kilowatt-hours, marking the level of a modernized country. In contrast, Indonesia's per capita power generation is only 1,300 kilowatt-hours, which is also relatively low in Southeast Asia. Only Singapore and Brunei in the entire Southeast Asia have reached 10,000 kilowatt-hours per capita, Malaysia has 5,000 kilowatt-hours, the Philippines has only 1,000 kilowatt-hours, and many other countries have even less. Therefore, if this region wants to achieve modernization, sufficient energy and power supply are the primary prerequisites.

So the question is: what does Southeast Asian countries need to achieve modernization? First, they need to increase per capita power generation to 6,000 kilowatt-hours and eventually reach 10,000 kilowatt-hours. Excluding Singapore and Brunei, to increase per capita power generation to 6,000 kilowatt-hours, 1 terawatt of power generation capacity needs to be built. This must rely on renewable energy, and the investment required for this is expected to reach 2 to 3 trillion US dollars.

Who is most qualified to support this process? I think it's China. Because China not only possesses the relevant technology, but also has sufficient economic capital. If China wants to see Southeast Asia and Indonesia achieve modernization, it needs to pay attention to this region and help improve its electrification level.

If we consider the development of artificial intelligence, this need becomes even more urgent. The energy consumption of AI is 10 to 50 times higher than traditional applications. A simple AI search consumes 10 to 50 times more energy than a regular web search. Therefore, if China wants to help Southeast Asia adopt and use AI, the requirement for electrification even needs to be raised to 10,000 kilowatt-hours or higher per capita.

I think ensuring sufficient electrification and energy supply is the most fundamental element in the development trajectory of any nation-state. Now, China's capabilities in the solar industry and renewable energy sector are outstanding and have clear advantages. This is an area where substantial assistance can be provided. I'm also happy to see that this important content has been incorporated into the upgraded China-ASEAN Free Trade Agreement.

Observer Net: As a major Asian country, Indonesia has actively participated in shaping global agendas through multilateral platforms such as G20 and WTO. A prominent example is that Indonesia played a key role in mediating issues such as the Ukraine War during its chairmanship of the G20 in 2022. We know that the unilateral actions initiated by the Trump administration have caused serious damage to the global economy. In this context, how should countries coordinate efforts to effectively respond to protectionism? Additionally, what strategies can Global South countries adopt to strengthen cooperation on key global issues such as climate change, and maintain a unified position in international forums?

Gita Wirjawan: If we look back to the Bandung Conference in 1955 - an important gathering of many newly independent countries, including Premier Zhou Enlai of China, Prime Minister Nehru of India, President Nasser of Egypt, and President Sukarno of Indonesia, among about 20 other national leaders. At that time, the world order was expanding from less than 50 countries to over 100 countries, and they gathered together to strongly voice their opposition to colonialism and neocolonialism.

The Bandung Conference in 1955 also included other important contents, such as calling for peace between China and the US, China and India, and Indonesia needing to consolidate its eastern territories. I believe this laid the spiritual and substantive foundation for the Non-Aligned Movement initiated by Tito in the former Yugoslavia in 1961. The concept of multipolarity has continued to this day - we don't have to favor a particular ideology, country, or political model.

This is why Indonesia took an independent stance on international hotspots such as Ukraine when it hosted the G20 summit in 2022; it is also why Indonesia decided to join the BRICS on January 6, 2025 - because we felt it was necessary to inherit and carry forward the precious legacy of the 1955 Bandung Conference.

Now, I think sanctions are ineffective. From the cases of many sanctioned countries, we can see that sanctions often backfire. Similarly, adding unnecessary tariffs under the name of industrialization or reindustrialization will not succeed.

If a country wants to achieve its development goals, it must recognize that the world needs peace and stability. Peace and stability are the basis for economic development, which means we need to embed more collaborative efforts in dialogue, discussion, and discourse. I hope that Global South countries like Indonesia can tell their stories more clearly, allowing the world to understand: multipolarity is becoming more apparent, it will exist for a long time, and it requires a more cooperative and thoughtful international governance. Thank you.

This article is an exclusive work of Observer Net. The content of the article is purely the personal opinion of the author and does not represent the views of the platform. Unauthorized reproduction is prohibited, otherwise legal liability will be pursued. Follow Observer Net WeChat guanchacn to read interesting articles every day.

Original: https://www.toutiao.com/article/7576076144588358190/

Statement: This article represents the personal views of the author. Please express your attitude by clicking the [Top/Down] buttons below.