【Wen / Observers Daily, Liu Bai】

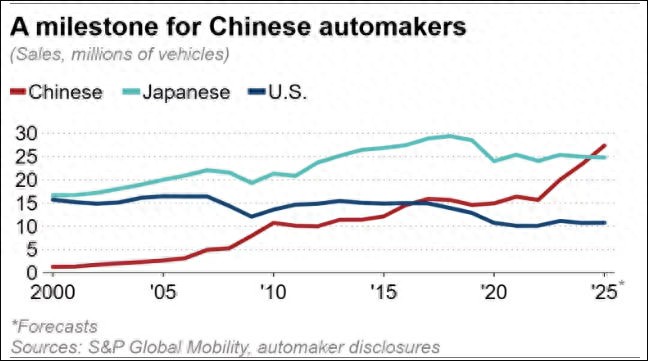

Not long ago, in 2023, China's auto exports surpassed Japan for the first time, ranking first globally. This year, Chinese car manufacturers are about to achieve another milestone!

On December 30, "Nikkei News" published an article predicting that Chinese automakers are expected to take the top spot in global new car sales in 2025, pushing Japanese manufacturers, which have held this position for over 20 years, to second place.

"Nikkei News" compiled the annual sales statistics based on company announcements and data from S&P Global Mobility for the first 11 months of this year. This statistics includes commercial vehicles, covering domestic and export sales.

The country of origin of the sales is determined by the company's shareholding ratio. For joint ventures with 50% shares each, the sales are attributed to the country of manufacture corresponding to the brand used at the time of sale.

The statistical results show that China's global auto sales are expected to increase by 17% year-on-year, reaching about 27 million units.

In 2023, China's auto exports reached 4.91 million units (excluding used cars), for the first time becoming the world's top exporter. The report states that after becoming the world's largest auto exporter, China is now preparing to take the title of global auto sales champion.

The Chinese market contributed about 70% of the sales of domestic automakers. China is vigorously promoting electric vehicles and plug-in hybrid vehicles. Currently, these new energy vehicles account for nearly 60% of the passenger car sales in China.

Trend of car sales in China (red), USA (blue) and Japan (green) since 2000

Japanese automakers' global sales this year are expected to remain roughly the same as last year, slightly below 25 million units. The US and Japan were the main competitors vying for dominance in the global market. Japanese automakers reached their peak sales in 2018, when sales approached 30 million units.

In 2022, Japanese automakers still led Chinese companies by about 8 million units, but this advantage vanished within three years.

Meanwhile, the competition in the Chinese auto market is very fierce. Data from the China Association of Automobile Industries shows that in the first 11 months of this year, the price range of the best-selling new energy vehicles was between 100,000 to 150,000 yuan, accounting for 23% of total sales.

Facing the increasingly severe competitive environment at home, Chinese automakers are turning their attention to overseas markets.

In the ASEAN market, where Japanese automakers have long dominated, Chinese car sales are expected to surge by 49% this year, reaching about 500,000 units. Data from Toyota's Thai subsidiary shows that as of November this year, Japanese cars accounted for 69% of new car sales in Thailand, a significant drop from around 90% five years ago.

In the European market, Chinese car sales are expected to grow by 7%, reaching about 2.3 million units. Despite the additional tariffs imposed by the EU on Chinese-made electric vehicles, Chinese automakers quickly adjusted their strategies, increasing the export proportion of plug-in hybrid vehicles that are not subject to these tariffs to cope with the policy impact.

In emerging markets, Chinese car sales are also rising steadily. African market sales are expected to increase by 32% to 230,000 units, while Latin American market sales are expected to rise by 33% to 540,000 units.

In September, Cui Dongshu, secretary-general of the Passenger Car Market Information Joint Conference of the China Auto Logistics Association, released an article predicting that during the "14th Five-Year Plan," the total annual sales of the automotive industry will reach 40 million units. At the same time, he believes that the industry has great potential to achieve this scale.

August 3, Shanghai, BYD participated in the ChinaJoy China Animation and Game Festival, launching a "pain car" co-branded with "Black Myth: Wu Kong." Visual China

Cui Dongshu predicted that by the end of the "15th Five-Year Plan" in 2030, compared to the end of the "14th Five-Year Plan" in 2025, the retail of narrow-sense passenger cars in the domestic market would grow by 1.8%, the total factory shipments would grow by 3%, imports would fall by 18%, and exports would grow by 10%; total domestic sales would grow by 2%, total exports would grow by 9%, and the overall growth rate of car sales would reach 3%, which is significantly slower than during the "14th Five-Year Plan" period.

It has been noted that as China grows into a mature automobile power, trade frictions may intensify globally. Many countries are using measures such as imposing tariffs and introducing new industry standards to protect their local automobile industries.

For example, the US and Canada have imposed a 100% tariff on electric vehicles made in China, while the EU's tariff rate reaches up to 45.3%. The EU is also developing standards for mini electric vehicles, relaxing technical requirements compared to ordinary electric vehicles, to encourage European manufacturers to produce in the region and thus strengthen their competitive position.

In response to the trade protectionist measures taken by the US and Europe against China's auto industry, the Chinese side once emphasized that division of labor and cooperation, mutual benefit and win-win are prominent characteristics of the auto industry chain. Trying to "trip others" instead of "running faster" actually harms its own long-term development and hinders the progress and prosperity of the world.

In the Chinese market, due to the slow progress of Japanese automakers in electrification, their market share is constantly being eroded by Chinese domestic emerging automakers.

Faced with a serious situation, some Japanese automakers have begun to refer to China's production model. For example, Nissan is working on exporting low-cost electric vehicles developed by Chinese-led R&D; Toyota is expanding its procurement of parts from Chinese suppliers in Southeast Asia to improve its cost competitiveness.

"Nikkei News" had previously disclosed in August that Toyota will procure parts produced by Chinese manufacturers in its largest production base in Southeast Asia, Thailand, and apply Chinese parts to new electric vehicles produced there starting in 2028.

A local parts company executive said that compared to Japanese enterprises, Chinese parts manufacturers are 20% to 30% cheaper. Some Japanese companies may face the dilemma of exiting or reducing their operations.

This article is exclusive to Observers Daily. Unauthorized reproduction is prohibited.

Original: toutiao.com/article/7589495911936426534/

Statement: The article represents the personal views of the author.