On the eve of Tesla's second-quarter earnings report on July 23, Musk returned to his "workaholic" state, trying to rebuild market confidence.

On Saturday Eastern Time, Musk posted on social media X that if his kids were not around, he would return to working seven days a week and sleeping in the office.

Analysts said this could be a signal from Tesla to regain market confidence. In recent months, Musk's attention seemed to have drifted away from Tesla. He first publicly supported Trump's campaign, then briefly joined a federal budget reduction working group, and later resigned and had a dispute with Trump. These political activities distracted him from Tesla, affecting the company's business performance, which is no small matter for a company with a price-to-earnings ratio of as high as 180 times.

Investors will focus on Tesla's latest developments in autonomous driving taxis, AI robots, plans to boost car sales, and promises of low-cost models. Most importantly, investors want to confirm that Musk is fully committed to Tesla and will continue to do so in the foreseeable future.

What New Story Can This Week's Earnings Tell?

Analysts pointed out that investors are focusing on five key issues during Tesla's earnings call.

1. Will Tesla's autonomous taxi catch up with Waymo?

Tesla finally launched its first autonomous taxi (robotaxi) service in Austin, Texas at the end of last month. Although this was just a test version, using a limited number of Model Y vehicles with safety drivers, it marked Tesla's official entry into the autonomous taxi sector.

Currently, Waymo, a subsidiary of Alphabet, operates in five major cities in the United States and leads the field. Supporters of Tesla believe that Tesla relies on its FSD system and does not need the expensive LiDAR used by Waymo, allowing Tesla to scale more quickly and at a lower cost.

The key question investors need to consider is how quickly Tesla plans to expand robotaxi to other cities?

2. Will Tesla invest in xAI?

Last week, Musk's Grok chatbot surpassed Meta's Llama and OpenAI and Microsoft's ChatGPT in pre-training capabilities and reasoning assessments, drawing industry attention. Although Musk denied merging xAI, the parent company of Grok, with Tesla, he hinted that there might be a shareholder vote on whether Tesla should invest in xAI. If this comes true, this investment may bring confidence to Tesla shareholders, proving that Tesla is diversifying into the booming AI industry to alleviate the pressure from slowing core electric vehicle business.

3. Can Tesla's electric vehicle business stabilize?

2025 will be the first year in five years that Tesla experiences a full-year revenue decline. In 2024, the company also experienced its first-ever profit margin decline due to declining sales and increased promotions. If Musk can convince investors that the toughest period is over, Tesla's stock may still have room to rise.

4. Can Tesla's energy business keep "charging"?

Tesla's energy division has been one of the few bright spots for the company recently. In 2024, the storage deployment volume of this business doubled year-on-year, and revenue growth reached as high as 67%. Investors will pay attention to whether this growth momentum can continue.

5. How will tariffs and politics affect Tesla?

Although the global trade landscape seems clearer after Trump announced tariffs in early April, the specific impact of tariffs on Tesla's profit margin remains uncertain. At the same time, after Musk's public quarrel with Trump, he threatened to establish a new political party. If he takes action, it may negatively affect the stock price. Historical experience shows that investors hope Musk focuses on operating Tesla and does not want him distracted by political affairs.

In addition, investors will also pay attention to updates on the product development timeline, including the "Optimus" humanoid robot.

Aside from these issues, for investors, the most important thing is to hear that Musk has fully re-committed to Tesla and will remain in this state in the foreseeable future. Historical precedents show that investors hope Musk focuses on company operations, and any external interference often leads to selling pressure.

Political Turmoil Has Dragged Down Stock Performance Multiple Times

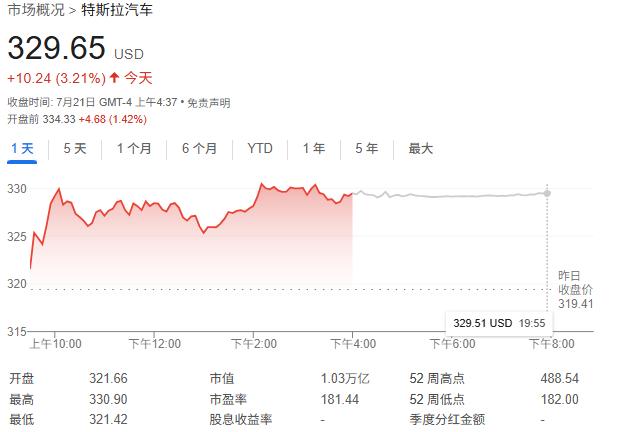

Since Musk loudly supported Trump's campaign last July, Tesla's stock price has become increasingly tied to political movements. At that time, Tesla's stock price was approximately $250. Subsequently, Trump's victory and market expectations of policy benefits favoring Tesla pushed the stock to a historical high of $488.

However, as concerns about trade tariffs intensified and Tesla's sales declined, Tesla's stock price fell below $215 in April. Later, Musk publicly clashed with Trump on social media, which further exacerbated the stock's decline. In the first half of 2025, Tesla sold only 721,000 cars, a 13% decrease compared to the previous year, below the 970,000 estimated by Wall Street.

As of Friday's closing, Tesla's stock price was $329.65, having fallen more than 18% year-to-date, but still rising more than 31% over the past 12 months.

Options market forecasts indicate that Tesla's stock is expected to fluctuate by ±7.4% after this earnings release. Compared to previous quarters, the average stock price fluctuation after actual earnings reports has been around ±10%. In terms of "earnings surprises," in the past seven quarters, Tesla failed to meet market expectations in six of them. In the last four quarters, the average "under-performance" was -8.33%.

Wall Street expects Tesla's second-quarter earnings per share to drop to $0.40, down from $0.50 in the same period last year. If the earnings report again shows a decline in profits, this will be the sixth time in eight quarters that the company has experienced a quarterly profit decline.

Despite the fundamental pressures, investors are still willing to give Tesla a high valuation (expected P/E ratio of 180 times in 2025), the core reason being investors' expectations of Musk's AI innovation capabilities, including Tesla's June launch of an unmanned taxi (robotaxi) and AI robots expected to be mass-produced in 2026. Additionally, the promise of "low-cost models" by Tesla's management remains one of the key factors. Although the market hasn't seen the actual car yet, if it is truly implemented, it could re-engage the mid-to-low-end market.

This article is from Wall Street Observer. Welcome to download the app to read more.

Original: https://www.toutiao.com/article/7529468743590314531/

Statement: The article represents the views of the author and welcomes you to express your opinion by clicking on the [top/vote] buttons below.