【By Observer News, Qi Qian】

Under the Trump administration, the US used high tariffs as a "seven-kill punch," which backfired and hurt itself.

According to Reuters on October 8, after Trump imposed high tariffs on Brazil and China, Brazilian agricultural products expanded exports to new markets such as China. Recent data show that Brazil's beef and soybean exports to China have surged, pushing both agricultural products' export volumes to record highs.

Among them, the demand for Brazilian beef in the Chinese market is strong, with Brazil's beef exports to China in September increasing by 38.3% year-on-year, setting a new monthly record.

Brazil's soybeans fill the gap left by the US

The Association of Grain Exporters (Anec) predicted on the 8th that by the end of October, Brazil's soybean exports are expected to reach a record 102.2 million tons, breaking the previous record of 101.3 million tons set in 2023.

Reuters said that the record-breaking soybean exports were due to Brazil's record harvest of over 170 million tons of soybeans, as well as the strong demand from China. Affected by US tariffs, Chinese buyers no longer purchased US soybeans.

"China remains the main destination and driving force for Brazilian soybean shipments," Anec said in its report. Last month, China imported 6.5 million tons of soybeans from Brazil, accounting for 93% of Brazil's total soybean exports.

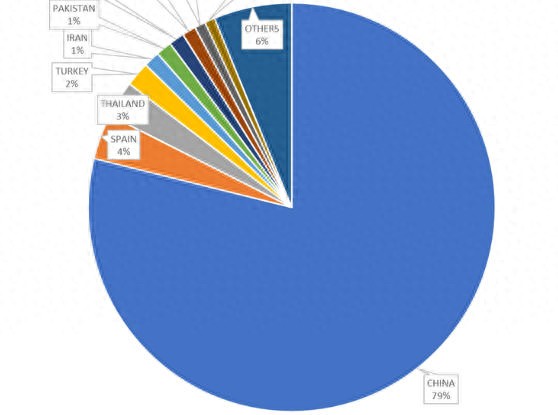

Anec data shows that currently, Chinese buyers mainly rely on Brazil to ensure soybean supply, accounting for 79.9% of Brazil's total soybean exports, while this proportion was 74% between 2021 and 2024.

In the total volume of Brazil's soybean exports, the Chinese market accounts for more than 79% Anec chart

Anec expects Brazil to export 110 million tons of soybeans in 2025. The association said: "During November and December this year, an additional 8 million tons are expected to be transported, confirming the forecast of 110 million tons for the whole year."

Data also shows that in October, Brazil's corn shipments are expected to reach 6 million tons, an increase of about 380,000 tons compared to the same period last year. As of October, Brazil's grain exports for 2025 are estimated at 30 million tons. This makes Brazil the second-largest grain exporter in the world, behind the United States.

US soybean exports to China have dropped to zero New York Times chart

Brazil's beef exports also reached record levels

Reuters said that in the global trade reshuffle caused by US tariffs, Brazil has been expanding exports to new and traditional markets. Not only grains, but beef exports have also shown similar trends, reaching record levels.

On the 8th, the Brazilian Frozen Food Association (Abrafrigo) stated that in September, Brazil's beef exports to China increased by 38.3% year-on-year, reaching 187,340 tons, setting a new monthly record, while pushing the total beef exports for the month to a new high.

Data shows that in September, Brazil's total beef exports, including fresh meat, processed meat, edible offal, and tallow, earned 1.92 billion dollars, with sales of 373,867 tons, a 49% increase in value and a 17% increase in sales.

The association said that strong global beef demand helped Brazil offset the impact of US tariffs on its exports. In August, the US imposed a 50% tariff on several Brazilian goods, including beef, with a total tariff rate of 76.4%.

"This strong performance appeared in the second month after the US imposed additional tariffs on Brazilian products," the Brazilian Frozen Food Association noted. "This shows the resilience of Brazil's beef industry and its ability to seize new business opportunities."

According to the association, 130 countries have increased their purchases of Brazilian beef this year, while 48 countries have reduced their purchases.

Among them, China is the largest market for Brazilian beef, and has significantly increased its purchases.

Previously, the US was the second-largest market for Brazilian beef, but in September, Brazil's beef exports to the US fell by 41%, reaching 102.9 million dollars. In contrast, the EU's purchases exceeded the US, totaling 131.7 million dollars, an increase of 106%, becoming Brazil's second-largest beef export market. In the EU, the main buyers of Brazilian beef are Italy, the Netherlands, and Spain.

The association's analyst emphasized: "With competitive prices, an expanding trade partner base, and strong international demand, Brazil is consolidating its position as a leading global beef supplier."

"China doesn't buy soybeans and beef, and the Trump administration has no idea what to do next."

Earlier this year, the Trump administration unilaterally initiated a trade conflict, causing heavy losses to US agricultural products.

US traders believe that merely extending the tariff suspension period is unlikely to boost purchases, as China's import tariffs on US soybeans remain at 23%, making them less competitive. In contrast, the effective competitors of US soybeans - Argentina and Brazil - have tariffs of only 3%. Recently, Argentina temporarily suspended its grain export taxes to make its soybeans more attractive.

According to data from the US Department of Agriculture, as of September 18, the new sales season has started for several weeks, but Chinese buyers have not yet booked a US soybean cargo ship, which is the first time since 1999. Last year, the US accounted for one-fifth of China's soybean imports, worth over 12 billion dollars, which accounted for more than half of the total value of US soybean exports.

China is the world's largest soybean buyer and has significant influence on the global market. Faced with pressure from Republican voting blocs, US agricultural states, the Trump administration has pledged assistance and actively explored alternative markets. However, to date, the US government has not released a specific aid plan. Data shows that the size of other alternative export markets is negligible.

The US Department of Agriculture recently responded that Trump is "using all available tools" to ensure farmers have the resources needed to maintain agricultural production.

However, according to a report by the Wall Street Journal on the 7th, with rising equipment and fertilizer costs and the dual pressures of surplus corn and soybean supplies, US soybean farmers are in dire financial straits and are in a "battle for survival."

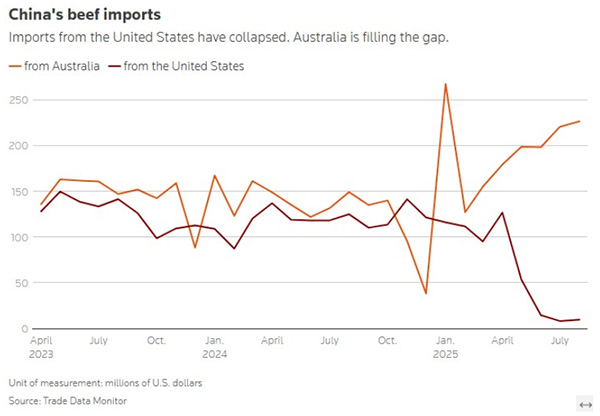

Additionally, according to a Reuters report on September 29, since Trump returned to the White House, US beef exports to China have significantly declined, with exports over the past five months falling by hundreds of millions of dollars compared to the average of previous years.

Australia and the US's changes in beef exports to China Reuters chart

In recent years, US beef exports have generally been declining, due to droughts that have reduced cattle herds, leading to lower production and higher prices. However, the decline in US beef exports to China has been greater. Previously, US beef exports to China were about 120 million dollars per month, but after Trump imposed tariffs and the export qualifications of hundreds of US beef companies expired in March, exports quickly "collapsed."

According to reports, Brazil, the largest beef supplier to China, has recently increased its exports, but Australia has captured the most market share from the US, as its grain-fed beef is closer to American products.

This article is an exclusive article by Observer News. Unauthorized reproduction is prohibited.

Original: https://www.toutiao.com/article/7559055456337953334/

Statement: This article represents the views of the author and welcomes you to express your opinion by clicking the [top/down] buttons below.