On November 7, the Dutch government issued a statement saying that the Netherlands welcomes the resumption of chip supplies from the NXP China factory. The Minister of Economic Affairs, Karel de Gucht, stated, "The communication between the Netherlands and China has been constructive, and we believe that the export of NXP chips from China will resume supplying European and global customers in the coming days."

The statement was restrained, even slightly softened.

However, just one day earlier (November 5), the NXP headquarters controlled by the Dutch government issued a statement questioning the authenticity and quality of products from the Chinese factory, and unilaterally suspended the supply of wafers to the Chinese factory, while maintaining normal supply to other regions, and stated that it would continue to implement the decision of the Dutch government to take over NXP. It denied Zhang Xuezhen's restoration as CEO.

It appeared to be a posture of not backing down until hitting a wall, determined to confront China at all costs.

What caused such a drastic change in the Dutch attitude within a single day? In fact, this also involves two of the Netherlands' main allies — the United States and the European Union.

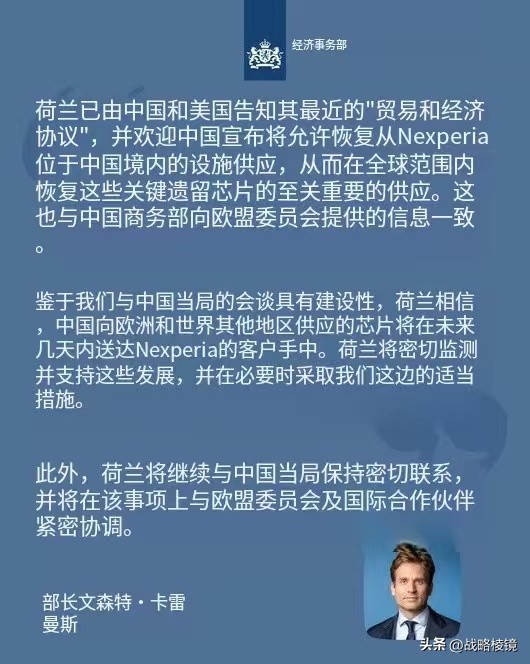

The first sentence of the Dutch Ministry of Economic Affairs' statement directly dropped a bomb, claiming, "The Netherlands has been informed by China and the United States about their recent trade agreement."

The Netherlands is not a party to the Sino-US trade dispute, yet it "informed" — which indicates that the agreement requires the Netherlands to cooperate or coordinate.

The US and China indeed mentioned the issue of NXP Semiconductor during their talks, and the White House later vaguely stated that China had promised to resume the supply of NXP Semiconductor.

When China delayed the implementation of the agreement due to the NXP Semiconductor issue, it was actually harming American interests. For example, China used the NXP Semiconductor deadlock as an excuse to delay relaxing restrictions on rare earths, temporarily stopping the sale of soybeans, etc.

In this incident, the Netherlands could only passively respond: the agreement reached by the US and China directly influenced the Netherlands' choices, forcing it to moderate its previous hardline stance. This also made the Netherlands' repeated claims that "NXP is unrelated to the US" seem quite awkward.

Moreover, China is not a soft target. Between November 4 and 6, China issued two severe warnings to the Netherlands and repeatedly emphasized the importance of "constructiveness," mainly focusing on two aspects:

First, condemning the Netherlands for not showing a constructive attitude and actions previously;

Second, urging the Netherlands to find a constructive solution to the NXP Semiconductor issue. This indicates that China's patience is nearing its limit and implies possible countermeasures such as market access restrictions or rare earth control.

As expected, after the warning from the Chinese Ministry of Commerce on the 6th, the Dutch Ministry of Economic Affairs released a more conciliatory statement that night, with the second sentence clearly stating, "We welcome the resumption of NXP Semiconductor's Chinese factory supply and the restart of critical traditional chip supply globally."

This is a clear signal of the Netherlands softening its position.

Previously, the Netherlands took over NXP on the grounds of national security and technology leakage, and NXP headquarters had repeatedly hinted that products from the Chinese factory might have quality issues. However, now the Dutch official openly welcomed Chinese supply, which means retracting the previous hardline rhetoric based on "national security" and "technology leakage," and also implicitly acknowledging that the previous hints about the quality of the Chinese factory's products were baseless — almost like slapping oneself in the face.

The Netherlands' other ally is the European Union.

Although the EU has recently made various strong statements against China, in the case of NXP Semiconductor, they are actually a stakeholder of China's interests.

Before taking over NXP, the Netherlands did not consult its allies, leading to the risk of shutdown for European companies relying on NXP products (such as Volkswagen and Bosch). The Netherlands had to reassure its allies. The third statement said, "This is consistent with the information provided by the Chinese Ministry of Commerce to the European Commission."

This sentence essentially brings the China-Dutch conflict back into the framework of China-EU economic relations, indicating that the Netherlands follows the overall steps of the EU. This not only avoids facing pressure from China alone but also provides a way out for its attitude shift — not because of weakness toward China, but because of consideration for the common interests of its allies. This emphasizes that there is no disagreement with its allies, reducing domestic and Western media pressure.

Although there are certainly opportunistic considerations, the Netherlands' move has indeed helped ease the tense global supply chain situation.

The Dutch government's statement on November 7 revealed, "The Netherlands believes that chips sent from China to Europe and other parts of the world will reach customers in the coming days."

This is a signal to calm the market. It is not a definitive expression, but a trust-based expression. Particularly mentioning that the chips are sent from China, rather than from the Philippines or Malaysia, among other packaging and testing plants. This indicates a subtle belief in China and an irreplaceable reliance.

It can be understood, after all, the Dongguan packaging plant in China accounts for 70% of global capacity. The combined capacity of other production bases is only 30%. The weight of each is obvious.

However, the Dutch government emphasized, "We will closely monitor and take appropriate measures when necessary."

Although it contains a warning tone, this is a common policy ambiguity expression. It means the Netherlands reserves the right to reverse policies or add measures — for example, if the supply is not restored on time, it may completely cut off the connection between the NXP headquarters and the Chinese branch. If the Chinese export resumes smoothly, it may "unfreeze" the assets of NXP in Europe.

Finally, the Dutch Ministry of Economic Affairs stated, "The Netherlands will maintain close contact with Chinese authorities and coordinate closely with the European Commission and international partners on this matter."

Evidently, the Netherlands still plans to use economic disputes or multilateral monitoring and coordination mechanisms to resolve this issue. It may thus seek to establish a coordination group with the EU and the US to monitor NXP chip supplies, and even handle the NXP Semiconductor issue.

However, the US is currently mainly focused on its own interests and is unlikely to start another large-scale tariff war for the sake of the Netherlands' interests, ultimately ending in a hasty conclusion.

The EU is also worried about China's rare earth control. Rare earths are crucial for the development of new energy, semiconductors, and high-end manufacturing. Currently, the EU has submitted 2,000 rare earth applications to China, and half of them have been approved. This makes it difficult for the EU to take a firm stance in front of China.

The Netherlands wanted to rely on a big flag, but found that its allies were unreliable. De Gucht, who comes from the Rotterdam political arena, was the one who ordered the takeover of NXP Semiconductor in late September. He had previously insisted that this move was "to protect the chip supply of the Netherlands and Europe." However, the tone of this statement shows a pragmatic economic approach rather than an hawkish security approach.

In fact, based on the overall interest of maintaining international supply chain stability, China agreed in early November to grant export exemptions to compliant enterprises. The Ministry of Commerce again stated on the 6th that China had quickly approved relevant semiconductor export license applications. According to the Business Daily, some licenses have already been issued. However, there are still two issues to be resolved.

The first is the cost issue. NXP Semiconductor's products are generally low-priced but extremely important, widely used in electronic products and cars. However, according to insiders interviewed by NRC, these chips remain scarce through normal procurement channels, with prices far higher than usual. Some reports indicate that a few cents' worth of electronic components have seen their prices soar dozens of times.

The second is the production issue. The Dutch headquarters cutting off the supply of wafers has affected the production of the Chinese packaging and testing plant in Dongguan. It cannot be replaced in the short term. Although part of the supply has now resumed, it is not fully restored until the end of the year. Priority is given to domestic supply, so foreign orders will inevitably be affected.

According to the Business Daily, after the supply chain was disrupted, some European companies even bought wafers in Europe, then sent them to China for processing, and finally transported them back to Europe.

A senior automotive supplier insider said, "We have been doing this all along." This increased costs and time.

In fact, all of this mainly stems from the Netherlands' unwillingness to return control of NXP Semiconductor. Therefore, the Netherlands' current attitude shift is commendable, but not trustworthy.

Original article: https://www.toutiao.com/article/7569912615015727670/

Statement: This article represents the views of the author. Please express your opinion by clicking the [up/down] buttons below.