【By Observer Net Columnist Yichen】

On August 1, the Hong Kong Stablecoin Ordinance will come into effect. Coincidentally, half a month earlier, on July 18, U.S. President Trump formally signed the "Guidance and Establishment of the United States Stablecoin National Innovation Act" (referred to as the GENIUS Act), which is the first stablecoin legislation at the federal level in the United States, marking the official establishment of the regulatory framework for stablecoins by the U.S. government.

The signing of the U.S. stablecoin regulatory act marks that dollar stablecoins have officially received official backing from the U.S. government, moving from the periphery and wild state to the forefront, from legally ambiguous to formal legal status, and from roaming in the gray area to entering the mainstream financial market.

Through the stablecoin act, the United States has established a comprehensive regulatory framework for dollar stablecoins, regulating aspects such as the qualification restrictions for stablecoin issuers, reserve requirements, compliance obligations, user protection, and international applicability, with the intention of promoting the development of dollar stablecoins to serve the economic and financial strategic goals of the United States. The introduction of the new U.S. stablecoin regulatory rules is an important event in the global financial field, and its stablecoins will have multiple impacts on the global financial system, and will profoundly change the direction and structure of the development of the global financial system.

Stablecoin Ordinance

The core content of the new U.S. stablecoin regulatory rules is: requiring stablecoin issuers to ensure that the tokens are pegged to the U.S. dollar at a 1:1 ratio, and to hold or invest the funds obtained from issuing the tokens in high-liquidity U.S. dollar assets, including cash, bank demand deposits, and U.S. Treasury bills.

From this core requirement, the U.S. government attempts to use the compliant development of dollar stablecoins to further release the global demand for dollar stablecoins, thereby creating new demand for the high U.S. national debt. As the expansion of dollar stablecoins continues, their growing global users will become new buyers of U.S. bonds, which will be transformed into a new important support for U.S. bonds.

It can be seen that the U.S. strategy for developing stablecoins is to maintain the sustainability of U.S. government debt, resolve the current U.S. bond crisis, and thus maintain the international position of the U.S. dollar, consolidate the U.S. global financial dominance in the era of digital currency, and prolong the life of the U.S. dollar hegemony.

What is a stablecoin?

A stablecoin is a cryptocurrency that is pegged to a certain fiat currency or to assets with stable value, such as gold, distinguishing it from other cryptocurrencies with frequent and drastic price fluctuations, allowing its price and value to remain relatively stable.

The operation mechanism of a stablecoin mainly maintains price stability through the anchoring assets. Depending on the type of anchoring asset, stablecoins can be divided into fiat-backed stablecoins (such as those pegged to the U.S. dollar), precious metal-backed stablecoins (such as those pegged to gold), crypto-backed stablecoins (such as those pegged to a certain cryptocurrency), and algorithmic stablecoins.

Because the United States has officially introduced the stablecoin regulatory act, other countries may also have the concept of stablecoins, but there is no formal legislation yet, so the definition and legal status of stablecoins in other countries are not clear. Currently, only the U.S. dollar stablecoins are formally defined, have a certain market size, and have significant influence.

Dollar stablecoins are typically pegged to the U.S. dollar at a 1:1 ratio. For every unit of stablecoin issued, the issuer needs to deposit an equivalent amount of U.S. dollars or U.S. dollar assets (such as short-term U.S. Treasury bills) in the reserve account. When market demand for stablecoins increases, the issuer can increase the corresponding U.S. dollar reserve assets and issue more stablecoins simultaneously; conversely, when market demand decreases, the issuer can repurchase stablecoins and reduce the U.S. dollar assets in the reserve account. To improve transparency and credibility, stablecoin issuers must regularly publish audit reports on their reserve assets.

Currently, the two largest stablecoins in terms of global market capitalization are Tether (USDT) and USD Coin (USDC), which together account for about nine-tenths of the total market capitalization.

USDC & USDT

Tether (USDT) is a virtual currency issued by Tether that links cryptocurrency to the U.S. dollar. Each Tether coin is backed by assets related to the U.S. dollar. Tether strictly adheres to the 1:1 reserve guarantee, meaning that for each USDT token issued, the company's reserve account has one U.S. dollar in cash or U.S. Treasury assets. Users can query their funds on the Tether platform to ensure transparency.

USD Coin (USDC) is a stablecoin pegged to the U.S. dollar, issued by Circle. It also uses a 1:1 U.S. dollar reserve model, primarily supported by high-liquidity assets such as U.S. Treasury bills and U.S. dollars, and ensures transparency and compliance through third-party custody and regular audits. USDC is widely used in cryptocurrency trading and cross-border payments in practice.

Other stablecoins, such as Dai, are also circulating in the market. Dai is a decentralized stablecoin based on Ethereum, maintaining its peg to the U.S. dollar through smart contracts and collateral mechanisms. Unlike traditional fiat-backed stablecoins, Dai's collateral assets can be various cryptocurrencies, increasing the flexibility of collateral assets but also carrying certain risks.

From the value assurance logic and operational mechanism of the U.S. dollar stablecoin, I tend to believe that the U.S. dollar stablecoin is a U.S. dollar token supported by non-Federal Reserve and non-governmental institutions through U.S. dollar asset collateral.

Background of the U.S. stablecoin legislation

In recent years, U.S. dollar stablecoins have shown strong growth potential. At the beginning of 2019, the total scale of U.S. dollar stablecoins was only $50 billion, and by 2025, it had rapidly increased to over $250 billion, a 50-fold increase. With the rapid development of the stablecoin market and its increasing influence in the financial system, governments, regulators, and all sectors have paid more attention to stablecoins.

The U.S. government's introduction of stablecoin regulatory legislation is obviously not aimed at "strengthening regulation" of stablecoins, but rather through stablecoin legislation, to give this cryptocurrency innovation, which was previously outside the scope of government regulation and lacked "legitimate identity", a clear legal identity, to carry out corresponding functions, and to use it to serve the U.S. government's strategic goals.

The U.S. government's introduction of stablecoin legislative measures has its profound political and economic background and significant strategic considerations:

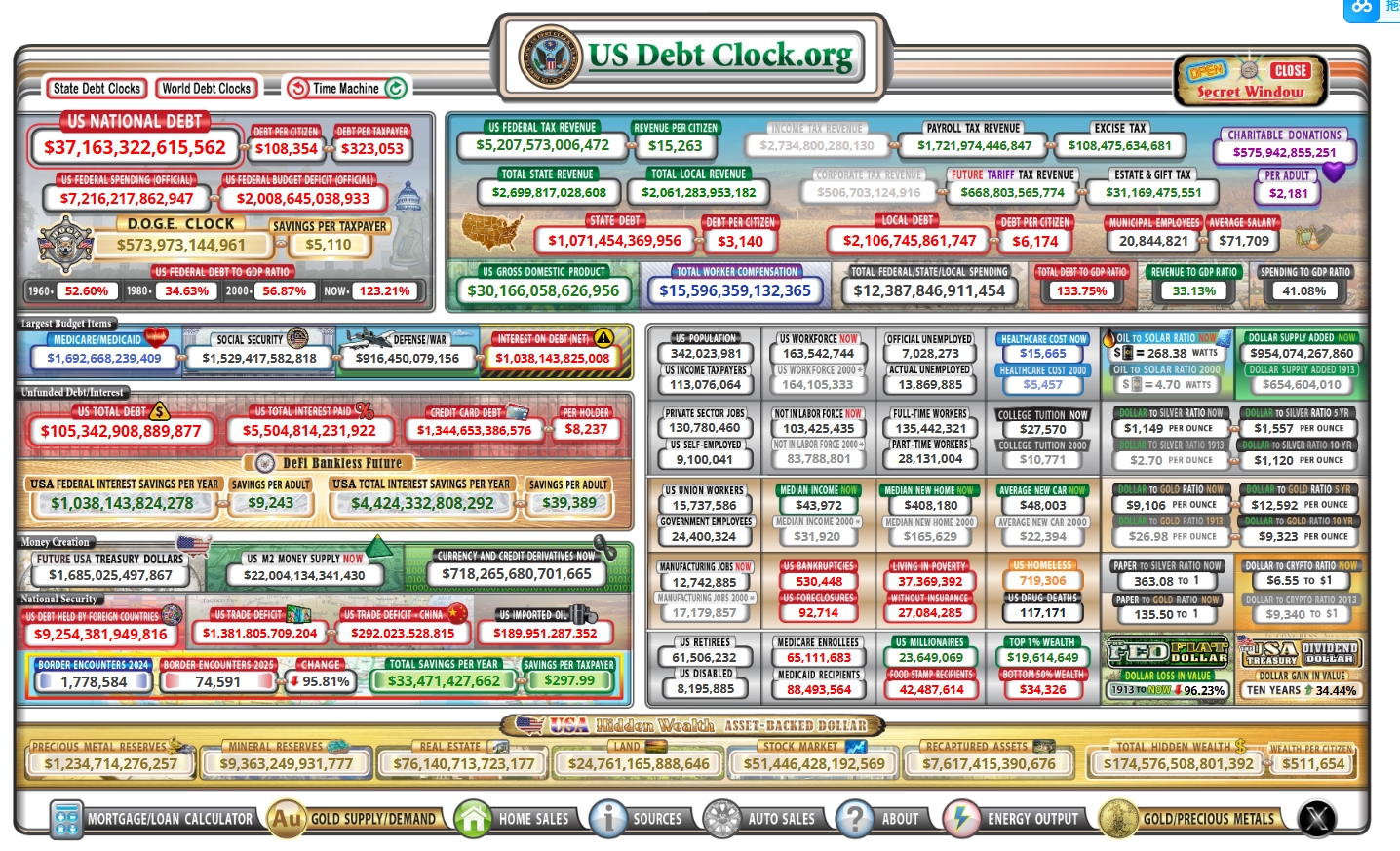

Firstly, the U.S. faces long-term fiscal deficits, high government debt, and unsustainable government debt. The current U.S. national debt balance has exceeded $36 trillion, with 80% of it maturing within the next four years, and increasing at a rate of approximately $1 trillion every hundred days. The U.S. government has long relied on debt to maintain operations, and fiscal deficits have been rising year by year. The U.S. fiscal deficit for the 2024 fiscal year broke through $1.8 trillion, with interest costs accounting for 3.93% of GDP. The projected fiscal deficit for the 2025 fiscal year is $1.9 trillion, accounting for 6.2% of GDP, reaching a historical high.

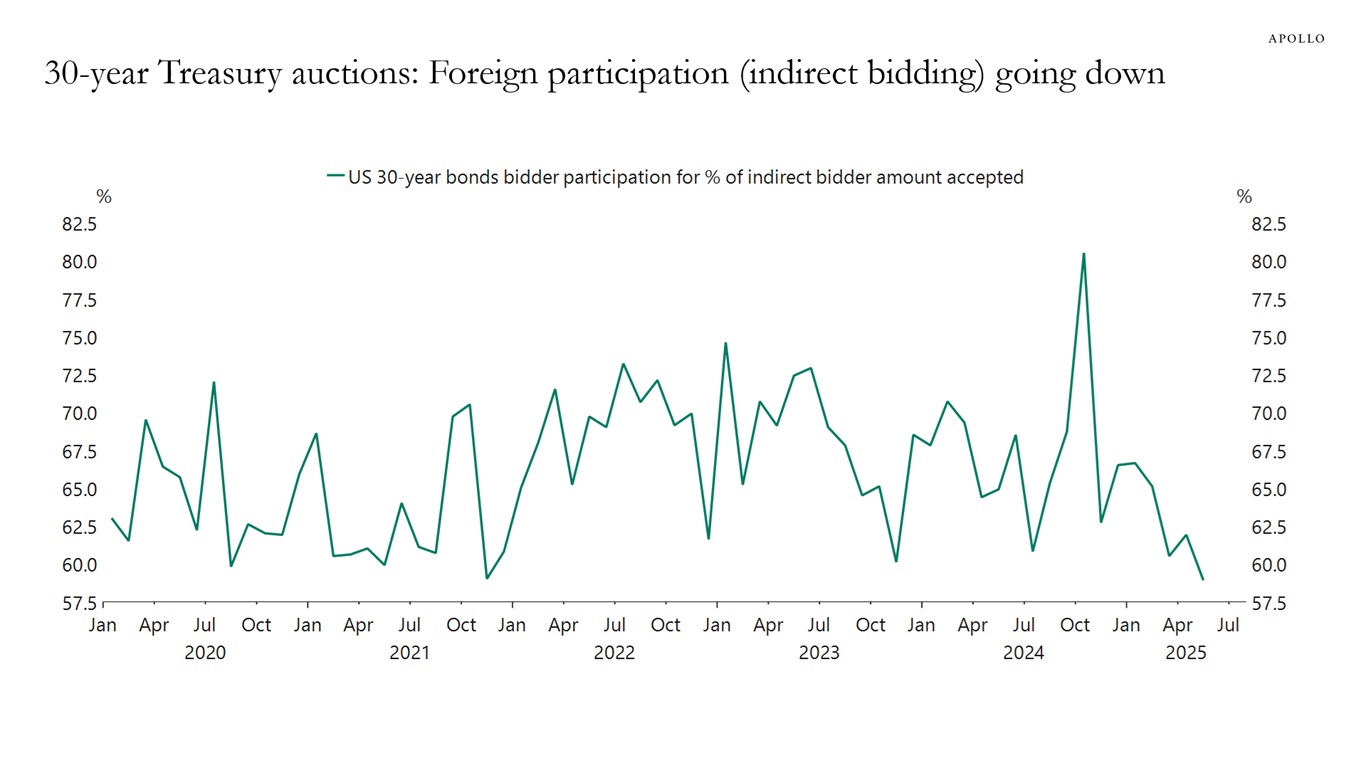

With high yields on government bonds, the indirect subscription ratio of U.S. thirty-year government bonds (measuring overseas demand) remains relatively low

Recently, the Trump administration passed the "Big and Beautiful Act," opening the legislative door for the U.S. to borrow more. It is expected that the federal government will add another $3.4 trillion in deficits over the next ten years, further exacerbating the U.S. government's debt problem. Fed Chair Powell, Elon Musk, renowned investor Ray Dalio, and JPMorgan's Jamie Dimon, among other opinion leaders, have warned: "The U.S. fiscal policy is on an unsustainable path" and "it is destined to cause a catastrophic crisis." Musk even said that the U.S. government's excessive spending would lead to the country's bankruptcy.

The unsustainability of the U.S. fiscal policy lies in the rapid expansion of U.S. government debt, which is draining investors' confidence in U.S. government bonds and increasing the interest on U.S. government bonds, adding to the cost of U.S. government debt. For a long time, the U.S. government has maintained the operation of the U.S. government bond through borrowing to repay the interest on the bonds, and more and more people recognize that the U.S. government bond is currently the largest super Ponzi scheme in the world.

Now, the U.S. government is facing a critical point in its debt dilemma: the surge in long-end bond yields has led to high borrowing costs, and the five-year and ten-year U.S. government bond yields have repeatedly set new highs. This year, the U.S. government has experienced repeated sharp declines in U.S. government bonds, and the U.S. government bonds have faced significant selling pressure, with yields rising sharply, reaching as high as 4.89%, and the ten-year U.S. government bond yield in July 2025 remained at a high of 4.41%, fully reflecting the market's concern about the U.S. fiscal deficit and inflation, which is proof of investors voting with their feet on U.S. government bonds.

Without new U.S. government bond investors, facing increasing government spending and fiscal deficits and market selling pressure, the refinance capacity of the U.S. federal debt is limited: either there are not enough buyers, or the U.S. government bonds must pay higher interest. This undoubtedly further increases the debt burden on the U.S. government, plunging it into a vicious cycle of debt.

Secondly, the erosion of the U.S. dollar credit and the rise of the "de-dollarization" trend caused by the U.S. debt crisis and geopolitical games, leading to a decline in the U.S. dollar's dominant position. In addition, the Trump administration's "America First" foreign policy, extremely personalized and capricious governance style, unclear objectives, and arbitrary tariff and trade policies have greatly increased the uncertainty and market chaos of the U.S. economy, further weakening the confidence of governments, institutional investors, and others around the world in the U.S. economy and the U.S. market.

This year, under the Trump administration's arbitrary, brutal, and chaotic tariff policies, the U.S. financial market has repeatedly experienced a rare "stock-bond-currency three kills" situation, with U.S. government bonds and the U.S. dollar facing panic selling, affecting the credit of the U.S. dollar. Additionally, after the Ukraine-Russia conflict, the weaponization and politicization of the U.S. dollar, using the U.S. dollar hegemony to implement financial sanctions, has increased doubts about the U.S. dollar, and "de-dollarization" is forming a wave of the times globally, with countries and regions such as Russia, India, Brazil, and ASEAN actively promoting the use of local currencies for settlement in international trade or seeking alternative currencies, posing an increasing challenge to the U.S. dollar hegemony.

Under these circumstances, the U.S. government launched the stablecoin legislation, placing its hopes for solving the U.S. debt pressure and continuing the U.S. dollar hegemony on the development of stablecoins.

Creating Buyers for Unsustainable U.S. Debt

The essence of the U.S. stablecoin strategy is a new solution for the U.S. debt crisis in the digital currency era. By linking stablecoins to the U.S. dollar and U.S. Treasury assets, the bill creates an "automatic demand engine" for U.S. government bonds. According to the bill design, stablecoin issuance must be pegged to the U.S. dollar or high-liquidity U.S. Treasury assets, which means that as the stablecoin market expands, the issuer needs to continuously purchase U.S. government bonds. For example, Tether has invested most of its funds in U.S. Treasury bills, and as of January 2025, Tether held U.S. Treasury bills worth $113 billion. If Tether were considered a country, it would become the seventh largest foreign holder of U.S. government bonds, ranking between South Korea and the UAE.

Because stablecoins must be pegged to the U.S. dollar or U.S. Treasury assets, for every additional $1 trillion in the U.S. dollar stablecoin market, if 60% of the stablecoins are pegged to U.S. Treasury bonds, it will inject $600 billion of new demand into the U.S. government bond market, greatly alleviating the pressure on the U.S. government's bond issuance and helping to lower the interest rate.

As of July 29, 2025, the U.S. national debt has exceeded $37 trillion

This demand does not come from the Federal Reserve's quantitative easing, but from the market-driven demand for stablecoin issuance, which avoids the inflation risk of debt monetization and strengthens the U.S. dollar's dominance in the world through the global circulation of stablecoins. More importantly, the overseas holders of stablecoins create new financing demand for U.S. government bonds: when overseas users hold stablecoins pegged to U.S. Treasury bonds, they effectively hold U.S. government bonds, and this "global borrowing" model is more efficient than traditional government bond issuance.

Since the number of stablecoin users is far greater than the number of U.S. government bond investors in the traditional financial market, this "stablecoin-U.S. government bond" financing loop significantly changes the landscape of the global U.S. government bond market, enabling the United States to maintain debt sustainability at a lower cost and higher efficiency, which is the core reason why the United States is willing to elevate stablecoins to a national strategy.

Regarding the above intentions, the U.S. government makes no secret of it. The U.S. "GENIUS Act" explicitly states the purpose of promoting stablecoin development: first, to promote the modernization of the U.S. payment and financial system; second, to strengthen and consolidate the international position of the U.S. dollar; and third, to create new demand for U.S. government bonds in the trillions of dollars.

U.S. Treasury Secretary Bensont, when urging the passage of the stablecoin legislation, stated on social media: "Promoting dollar stablecoins helps maintain the status of the U.S. dollar as the world's currency." The CEO of Tether (USDT) also strongly promotes the role of Tether in supporting the U.S. dollar's position, stating in an interview with Bloomberg: "We represent the most important application scenario for the U.S. dollar's global hegemony. We are building infrastructure for the U.S. dollar system from scratch in emerging markets... Tether is the last fortress supporting the U.S. dollar."

Stablecoins, by being pegged to the U.S. dollar, not only help expand the U.S. government bond market, but also help consolidate the U.S. dollar's global position, thus prolonging the U.S. dollar's hegemony. The underlying logic is also the "stablecoin-U.S. government bond-U.S. dollar" closed-loop logic:

By being pegged to the U.S. dollar and U.S. government bond assets, stablecoins become a digital extension of the U.S. dollar. At the same time, leveraging the existing international reserve currency and the dominant currency in international trade, U.S. dollar stablecoins have a significant advantage in competing with stablecoins of other countries, and therefore, in the new global digital currency competition, U.S. dollar stablecoins may replace other countries' fiat currencies in international trade and cross-border payments, thereby strengthening the U.S. dollar's international pricing and settlement currency status, forming a mutually reinforcing positive cycle.

Dollar stablecoins are ultimately a fleeting moment of a dying hegemony

From a systemic design perspective, promoting dollar stablecoins has become a "lifeline" for the U.S. government to solve the U.S. debt crisis and continue the U.S. dollar hegemony, with a very clever calculation. However, so far, including dollar stablecoins, stablecoins are still a small and new thing, and the total market size of stablecoins worldwide is still very narrow. Even for dollar stablecoins, the total scale is only about $260 billion; and the application scenarios are very limited, currently mainly applied in cryptocurrency trading and cross-border payments, with a narrow user base, mostly used for evading regulation or circumventing U.S. sanctions. Most are connected to the gray economy.

The attributes of stablecoins as a cryptocurrency make their transactions have characteristics of secrecy and anonymity, often being used by criminals for tax evasion, money laundering, and criminal activities. Whether stablecoins can successfully shoulder the new engine of U.S. bond demand and the major mission of continuing the U.S. dollar hegemony remains uncertain.

Stablecoins have advantages in payment functions compared to traditional financial payment methods and systems, which is a factor in their existence and acceptance by users. In terms of technical attributes, stablecoins belong to cryptocurrencies, and blockchain technology has made revolutionary progress in stablecoin payments.

Stablecoins provide an alternative to bypass or simplify traditional hierarchical structures, using digital means to achieve more direct cross-border payments. By using stablecoins, cross-border payments no longer require multi-day clearing through the SWIFT system, but can be completed in minutes, breaking the existing pattern and reducing transaction costs, making stablecoins potentially bring significant changes to the payment system.

The "decentralized" circulation characteristics of stablecoins restructure the time and space dimensions of value transmission. Traditional payment systems need thousands of bank branches and complex clearing systems to complete cross-border payment services, while stablecoins can achieve instant settlement globally through code protocols alone. For e-commerce sellers, businesses or individuals engaged in small-scale cross-border trade, this cost reduction is highly attractive, and thus may bring demand for stablecoins.

At the same time, the immutability and distributed storage of blockchain technology make stablecoin transactions have "censorship-resistant" characteristics, making it impossible for any institution to freeze user assets or intercept transactions. The privacy characteristics of stablecoin cross-border payments may be a more important reason for users to accept and use stablecoins. For example, in countries with strict capital controls to evade regulation, and countries subject to U.S. and other international institution sanctions to circumvent sanctions. Stablecoin cross-border payments can bypass the U.S.-dominated international payment system, thus avoiding financial sanctions in geopolitical economic competition.

Media such as Forbes have reported on the use of cryptocurrencies for cross-border payments in countries like Iran

For example, under the severe financial sanctions imposed by the U.S. and Europe, Russia turned to stablecoins to conduct oil trade with other countries, using USDT as a bridge for domestic currency trade settlements; countries such as Iran and Venezuela have also used cryptocurrencies for trade settlements.

Additionally, in some countries with small economies or economically vulnerable economies, or those with high inflation and continuous depreciation of their local currencies, the business entities in these countries often have a large reliance on the U.S. dollar, and the U.S. dollar is widely used in the local market, which also generates demand for U.S. dollar stablecoins.

For example, Turkey, Argentina, Indonesia, and India have seen an increase in the willingness of residents to hold stablecoins, with Turkey's 2023 stablecoin purchases using fiat currency equivalent to 3.7% of GDP. In countries with high inflation such as Argentina and Nigeria, stablecoins have become a lifeline for some people to preserve their assets, with some individuals directly converting their wages into stablecoins through local cryptocurrency applications to pay rent, daily expenses, and complete fund transfers.

Currently, U.S. dollar stablecoins are leading in the global stablecoin and cryptocurrency market, and by leveraging the U.S. dollar's continued dominance in international reserves and international trade payments and settlement systems, U.S. dollar stablecoins have a natural advantage over other fiat currency stablecoins, so in future global stablecoin competitions, such as cross-border payments, U.S. dollar stablecoins will still have a crushing advantage over other currency stablecoins, which in a way supports the maintenance of U.S. dollar hegemony.

However, given the current small scale of stablecoins and limited application scenarios, which are limited to certain specific user groups and specific transaction purposes, the acceptance and popularity of stablecoins are far from comparable to traditional banking payment methods, and their development prospects remain to be observed.

As of 2025, the stablecoin market size is approximately $260 billion, and according to Standard Chartered Bank's forecast, the stablecoin market size could reach $2 trillion by 2028. This volume is still insignificant compared to the scale of global circulating currency. In 2025, the global cross-border payment market size exceeded $250 trillion, and there is no authoritative data indicating what proportion of it uses stablecoins.

At the same time, due to the inherent characteristics of stablecoins, which include hidden fund flows and difficult-to-monitor transactions, as stablecoins develop, countries will inevitably further tighten regulations on stablecoins, requiring stablecoin issuers to increase customer background and business background information. After the U.S. introduced stablecoin regulatory legislation, other major central banks around the world quickly responded, generally expressing caution, concern, and vigilance towards it.

ECB President Lagarde emphasized in a hearing that it is necessary to quickly establish a legislative framework to pave the way for the introduction of a digital euro (central bank digital currency) to address the challenges posed by the rapid development of stablecoins. Notably, her proposed European response is not to introduce a euro stablecoin, but to establish a digital euro. Bank of England Governor Andrew Bailey has also warned about stablecoins in different occasions: stablecoins pose systemic risks to banking institutions, which may disrupt the stability of the entire financial system and cause the sovereign government to lose control over its currency.

The countries and regions with the most severe impact from stablecoins are those with weak financial systems, and in extreme cases, they may threaten the monetary sovereignty of the country. In 2025, the International Monetary Fund (IMF) warned that the presence of large-scale stablecoins may weaken the monetary policy independence of emerging market countries and exacerbate the instability of the global financial system.

The Bank for International Settlements warned that the rapid expansion of stablecoins brings new policy challenges to countries' financial regulators, and may even threaten the monetary sovereignty of major economies. The widespread use of stablecoins will inevitably have a strong impact on the local financial system. Once a stablecoin crisis occurs, it is easy to trigger a chain reaction of market trust crises, leading to the outbreak of a run.

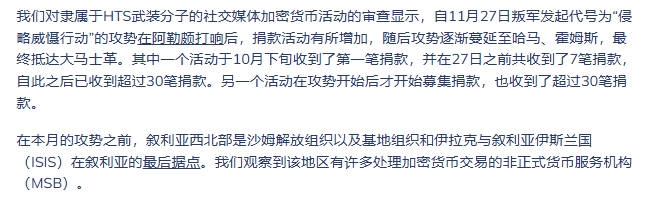

In 2025, the Financial Stability Board (FSB) released a report stating that there are "major loopholes" in the cross-border regulation of stablecoins. This regulatory vacuum not only increases financial risks but may also be exploited by criminals for money laundering, terrorist financing, and other illegal activities.

Last December, a report from the independent website Chain Alysis, which focuses on blockchain dynamics, showed that HTS received dozens of donations through cryptocurrency channels before and after the fall of the Assad regime in Syria.

Other central bank governors have also expressed concerns about the development of stablecoins, including the risk of stablecoin collapse and the fact that large amounts of money flow outside the formal banking system, which fuels money laundering and other crimes, and called for the enactment of laws to regulate stablecoin companies with the same standards as traditional banks, such as strict constraints on customer identification (KYC), anti-money laundering (AML), anti-terrorist financing, capital adequacy, deposit insurance, and liquidity management.

It can be foreseen that as the scale of stablecoins expands and their application range extends, governments, including the United States, will inevitably strengthen the regulation of stablecoins, and will not allow stablecoins to remain unregulated. For example, the new U.S. regulatory rules clearly state that issuers with a market capitalization exceeding $100 billion must be supervised by the Federal Reserve. At the same time, countries will strengthen regulatory measures to protect their own monetary sovereignty and avoid threats to their monetary sovereignty, and will impose restrictions and regulations on the use of U.S. dollar stablecoins. As countries take measures and tighten regulations, it will pose resistance to the global expansion of U.S. dollar stablecoins.

For the United States, the development of U.S. dollar stablecoins also has disadvantages and poses a boomerang to the U.S. dollar hegemony itself:

Firstly, since U.S. dollar stablecoins provide a new path to bypass the tightly regulated traditional U.S. dollar payment system, countries or organizations subjected to U.S. financial sanctions can use the U.S. dollar stablecoin payment channels to circumvent sanctions, which will create a major loophole in U.S. financial sanctions, thus weakening the effectiveness of the sanctions.

Secondly, promoting the rapid development of stablecoins and preventing crime, money laundering, and other safety goals are difficult to reconcile. If stablecoins are subject to strict regulations similar to those of banks, the privacy and lack of monitoring of stablecoin payments and fund flows will no longer exist, and the stablecoin market and user base will be difficult to rapidly expand.

Thirdly, the security risks of stablecoins themselves will also pose a threat to the stability of the U.S. financial market.

Although blockchain technology is difficult to tamper with, it is not absolutely secure: smart contract vulnerabilities may lead to attacks on stablecoins, poor private key management may result in loss of user assets, and flaws in consensus mechanisms may cause network paralysis. Historically, hacking incidents against cryptocurrency exchanges have been frequent. As a bridge connecting traditional finance and cryptocurrency, stablecoins may accelerate the flow of funds between the two markets, increasing market volatility.

In summary, the Trump administration intends to use the development of stablecoins as a means to resolve the U.S. debt crisis and as a new weapon to extend the U.S. dollar hegemony. Although the strategic design is ingenious, there are still many obstacles to achieving this goal, and whether it will succeed remains questionable.

I believe that the development prospects and influence of U.S. dollar stablecoins depend on the international status and credit of the U.S. dollar, and ultimately depend on the prospects of the U.S. economy's stability and growth. Once the credit of the U.S. dollar collapses, the U.S. dollar stablecoins, which rely on the U.S. dollar, will also lose their foundation. Even if U.S. dollar stablecoins can temporarily save the U.S. dollar hegemony, it will only be a fleeting moment of the U.S. dollar hegemony approaching death.

This article is an exclusive article from Observer Net. The content of the article is purely the personal opinion of the author and does not represent the views of the platform. Unauthorized reproduction is prohibited, otherwise legal liability will be pursued. Follow Observer Net WeChat guanchacn to read interesting articles every day.

Original: https://www.toutiao.com/article/7533082122274308660/

Statement: This article represents the views of the author, and we welcome you to express your attitude by clicking on the [Top/Down] buttons below.