On September 12, the China Banking and Insurance Regulatory Commission (CBIRC) issued new penalty notices.

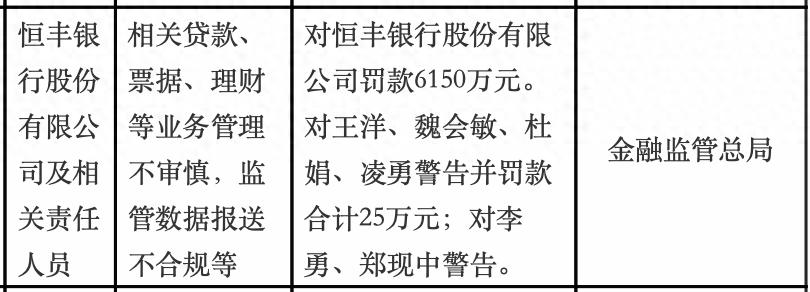

The CBIRC's list of publicized administrative penalty information shows that due to unprudent management in related loan, bill, and wealth management businesses, and non-compliant reporting of regulatory data, Hengfeng Bank was fined 61.5 million yuan. At the same time, Wang Yang, Wei Huimin, Du Juan, and Ling Yong were warned and fined a total of 250,000 yuan, while Li Yong and Zheng Xianzhong were warned.

On the same day, Hengfeng Bank responded on its official website, stating that the bank recently received the administrative penalty decision document from the CBIRC regarding the problems identified during the 2023 on-site inspection of risk management and internal control effectiveness.

Regarding the regulatory penalty decision, Hengfeng Bank has given it high importance, accepted it humbly, deeply analyzed the root causes of the issues, and has implemented the relevant problem rectification and accountability measures. In the next step, the bank will strictly implement all policies and regulatory opinions, comprehensively enhance internal control compliance and risk management levels, continuously improve the quality and efficiency of services for the real economy, and effectively promote the stable and sustainable transformation and development of the bank.

However, this penalty is not the first one for Hengfeng Bank in 2025.

In January 2025, Hengfeng Bank was warned and fined 10.6068 million yuan for violating eight illegal and disciplinary acts, including account management regulations and anti-counterfeiting currency business management regulations. In the same month, Hengfeng Bank's Kunming Branch was fined 2.05 million yuan by the Yunnan Banking Regulatory Bureau for issues such as unprudent management of working capital loans.

In February 2025, Hengfeng Bank's Shanghai Branch was fined 3.7 million yuan for five violations, including unprudent disbursement of fixed asset loans.

In August 2025, Hengfeng Bank's Chongqing Branch was fined 2.6 million yuan by the Chongqing Banking Regulatory Bureau for issues such as concealing bad loans, inadequate investment management, and insufficient "three checks" in loan processes.

According to an incomplete statistical report by the media, since 2025, Hengfeng Bank has been fined more than 80.45 million yuan in total.

Hengfeng Bank is one of the 12 national shareholding commercial banks. It was originally established as the Yantai Housing Savings Bank in 1987. In 2003, it was restructured into Hengfeng Bank with the approval of the People's Bank of China.

Starting in late 2017, the bank initiated market-oriented reforms, and by the end of 2019, it had stripped off bad assets and introduced strategic investors, completing the first two steps of the three-step reform and restructuring plan approved by the State Council—stripping bad assets, introducing strategic investors, and overall listing. This made it a successful case of jointly resolving financial risks of national banking institutions within the framework of marketization and rule of law.

Currently, Hengfeng Bank has a registered capital of 111.2 billion yuan, ranking fifth among Chinese banks. The state-owned equity accounts for approximately 89.70%, foreign equity for 3%, and private equity for about 7.30%, forming a clear, stable, and diversified ownership structure dominated by state shareholders.

Previously, Hengfeng Bank attracted attention for welcoming the "youngest president among shareholding banks."

On June 30, the official website of the CBIRC showed that the CBIRC approved Bai Yushi's appointment as a director and president of Hengfeng Bank, with the approval date being June 19.

Public reports indicate that Bai Yushi was born in 1982, graduated from the Chinese Academy of Social Sciences, and holds the title of Master of Economics. He is also a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA), and Financial Risk Manager (FRM), making him a top-tier finance professional. Within ten years, he transformed from a "newcomer in the bank" to a "president at the head office."

Bai Yushi joined Hengfeng Bank in July 2015. He served as Assistant General Manager, Deputy General Manager, and Deputy General Manager (in charge) of the Asset and Liability Management Department, Deputy General Manager (in charge) and General Manager of the Financial Markets Department, and Head of the Fund Operations Center. From June 2022, he served as a member of the Party Committee of Hengfeng Bank, and from January 2023, he became the Deputy President of Hengfeng Bank.

The "80s-born" individual taking over the presidency of Hengfeng Bank—what considerations lie behind this personnel arrangement?

Wang Pengbo, Chief Analyst of the Financial Industry at Bocai Consulting, believes that facing more market competition, innovation and a younger management team can help explore a differentiated development path through new thinking and methods.

Data shows that in 2024, Hengfeng Bank achieved an operating income of 25.775 billion yuan, an increase of 1.98% year-on-year; profit before tax reached 7.442 billion yuan, decreasing by 930 million yuan compared to the previous year. However, due to a significant reduction in income tax expenses by 1.151 billion yuan, Hengfeng Bank achieved a net profit attributable to its shareholders of 5.454 billion yuan in 2024, an increase of 5.99% year-on-year, but still a decrease of nearly 19% compared to 2022.

Since the beginning of 2024, Hengfeng Bank has repeatedly mentioned preparations for listing, and has set "integrating forces through overall listing" as one of its main goals for the coming period.

Externally, it is believed that after completing equity transfers and the new president's appointment, Hengfeng Bank continues to strengthen corporate governance. However, to achieve the listing goal, it still needs to improve compliant operations and continuously enhance its core profitability.

From July 31 to August 1, Hengfeng Bank held its 2025 mid-year work conference. The Party Secretary and Chairman, Xin Shuren, attended the meeting and delivered a speech, while the Party Deputy Secretary and President, Bai Yushi, deployed the business work.

Hengfeng Bank Website

The meeting pointed out that this year, the entire bank has aimed at the "1443" target positioning, thoroughly implemented the "1476" transformation and development strategy, and fully advanced the "five major battles." Many works have achieved new breakthroughs, and the operation and development have reached a new level. The service for the local area has been strengthened, and the shortcomings in internal control and risk prevention have been rapidly addressed. The effect of the inspection and correction has been continuously consolidated. The total assets of the bank have reached 1.55 trillion yuan, achieving an operating revenue of 14 billion yuan and a net profit of 3 billion yuan. For two consecutive years, both operating revenue and profit have seen "double increases," with the non-performing loan rate dropping to 1.47%. The entire bank presents a steady and positive development trend, with progress and improvement in quality.

(Comprehensive source: Da Xiang Wealth, Changjiang Business News, Interface News, and The Paper.)

This article is an exclusive work by Observer Network. Without permission, it cannot be reprinted.

Original: https://www.toutiao.com/article/7550267904428671528/

Statement: The article represents the views of the author and welcomes your attitude by clicking on the [top/bottom] buttons below.